Jan 11, 2022

Murphy’s Progressive N.J. Agenda Has More Obstacles in Second Term

, Bloomberg News

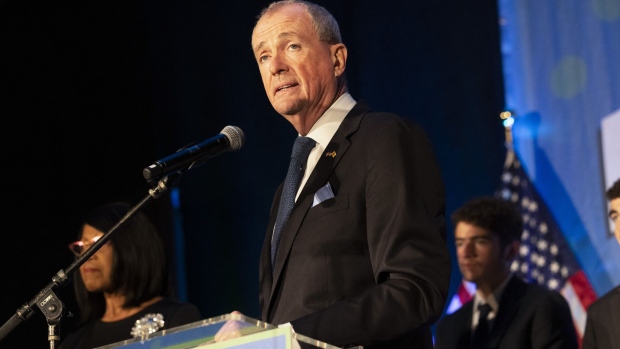

(Bloomberg) -- New Jersey Governor Phil Murphy enters his second term facing more challenges to fund his progressive agenda than when he took office four years ago.

The retired Goldman Sachs Group Inc. senior partner won re-election in November by 3.2 percentage points, an unexpectedly tight race that stunned the state. And almost two years into the pandemic, amid a spike that has pushed the positive rate of infections past 31%, Murphy is defending Covid-19 precautions against critics who say they’re too stringent: Dozens of the Democrat’s emergency orders and directives expired Tuesday when legislative leaders blocked his extension request.

In his first major policy speech since the election, Murphy on Tuesday evening is expected to reaffirm his mission to make New Jersey a fairer place to live. His State of the State address -- which he taped and will air virtually due to a winter Covid surge -- will stress economic growth, aid to working and middle-class families and health-care affordability, according to Alyana Alfaro, a Murphy spokeswoman.

“Despite the pandemic’s efforts to knock us down throughout 2021, we kept our state moving forward in so many ways, and we have a lot to look forward to for this year,” Murphy, 64, said at a Monday briefing. “We have not only made real progress to restoring our sense of normalcy even in the teeth of this pandemic, we’ve also made real progress in making our economy stronger and working for more of our families.”

Murphy this term must deal with a legislature that has a smaller Democratic majority. Gone is Democratic Senate President Steve Sweeney, who helped pass some of Murphy’s first-term priorities, and who lost his own stunning re-election race to a Republican truck driver.

Republicans and even some Democrats call much of Murphy’s agenda out of step and unaffordable.

During his first term, Murphy increased the minimum wage, expanded paid family leave, enacted free community college for low-income students, strengthened the state’s gun laws and expanded voter protections. On Monday, he pledged to sign a bill guaranteeing a woman’s right to choose, amid a national debate over abortion.

Murphy already has pledged not to raise taxes again during his second term, following a millionaires tax enacted in 2020 that increased rates paid by residents making more than $1 million to 10.75% from 8.97%. “When we have tax fairness, we can continue our historic investments in our pension systems and in our middle-class families,” he said in 2020.

Indeed, the income has been used, in part, to provide rebate checks of as much as $500 to roughly 760,000 households. In November, Murphy became the first New Jersey Democratic governor since 1977 to win re-election.

Property taxes remain highest among U.S. states, averaging $9,112 in 2020. A state comptroller review last week of New Jersey’s corporate tax-breaks program found positive reforms, as Murphy had vowed, but still short on transparency and slow to revoke unearned benefits. Murphy a year ago authorized $14 billion in such incentives to replace a troubled system.

More immediately, the state’s 79 acute-care hospitals are bracing for as many as 8,000 virus-infected patients, nearing the high in April 2020. At the same time, the state’s 6.6% unemployment rate in November was more than 2 percentage points above the U.S. average.

“People are angry,” Sweeney, referring to the overall results of New Jersey’s November election, said in an interview. Sometimes allied with Murphy, Sweeney was unseated on a conservative tide in his southern New Jersey district. “We’re not talking about the economy, not talking about getting back where we want to be.”

Alfaro declined to comment on Sweeney’s remarks.

Financial Snapshot

The state’s financial picture has improved despite Republican predictions of economic devastation wrought by Covid and Murphy’s $11 billion increase in annual state spending. New Jersey started the fiscal year on July 1 with a $10.1 billion surplus, almost $4 billion higher than what the Murphy administration had forecast a year earlier. That was the result of a two-month surge in revenue collections in April and May, for an historic high.

Like California and Texas, New Jersey has seen revenue supercharged by retail sales beyond pre-pandemic levels. Sales tax revenue rose 13.9% to $953.6 million in November, according to the latest data from the New Jersey Department of Treasury. Year-to-date collections totaled $4.06 billion, or 12.1% higher than the same period last year, an influx of cash that Murphy was criticized for not funneling toward taxpayer relief.

In addition, 60% of the $6.2 billion in federal Covid stimulus aid remained unspent as of October. The state has until 2024 to decide how to use the money, which Murphy has said he won’t use to plug holes or start programs that need funding after federal aid expires.

©2022 Bloomberg L.P.