Feb 16, 2024

Naver Taps Goldman, Morgan Stanley for Webtoon Unit’s US IPO

, Bloomberg News

(Bloomberg) -- Naver Corp. has enlisted Goldman Sachs and Morgan Stanley to work on a US initial public offering for its online comics operator over the summer, accelerating the much-anticipated market debut of one of its fastest-growing businesses.

The company could seek to raise as much as $500 million at a valuation of $3 billion to $4 billion, according to people with knowledge of the matter. It’s targeting a timeframe of as early as June and could invite more underwriters apart from the two investment banks, the people said. The timing however may ultimately hinge on market conditions and there’s no guarantee Naver will go ahead, the people said, requesting anonymity to discuss confidential information.

Naver has considered listing the business since 2021, around the time the novel medium began to catch on in major markets such as the US. Today webtoons — short-episode digital comics designed for scrolling on mobile devices — are considered one of Korea’s more successful cultural exports alongside K-pop and drama series, driving business for Naver and rival Kakao Corp.

Naver, a leader in Korea in online services from search and shopping to social media, is pushing to list US-based Webtoon Entertainment Inc., which owns the online comics platform Naver Webtoon and the internet novel service Wattpad that they acquired in 2021. It’s considering a US debut in part to drive its ambitions abroad.

Read More: Webtoons Are Latest South Korean Cultural Export to Find US Fans

What Bloomberg Intelligence Says

Naver could find it challenging to launch a Webtoon IPO given the business’s rapidly slowing growth outlook, which is being compounded by rising competition following the entry of Apple and Amazon into the web comic sector. Naver’s content sales rose just 6.6% year on year in 4Q22, with the division’s sales growth forecast to slow to 12.9% in 2024... Naver could seek to raise $500 million at a valuation of $3-$4 Billion in a US IPO of Webtoon, according to Bloomberg News.

- Robert Lea and Jasmine Lyu, analysts

Click here for the research.

The discussions around an IPO are ongoing and details such as size or value could change, the people said. Naver and Naver Webtoon representatives declined to comment. Goldman and Morgan Stanley spokespeople also declined to comment.

Naver still derives the bulk of its revenue from its native country but has quickened overseas deals to target bigger markets, particularly the US. It’s following in the footsteps of larger rival Coupang Inc., which pulled off a successful US IPO in 2021.

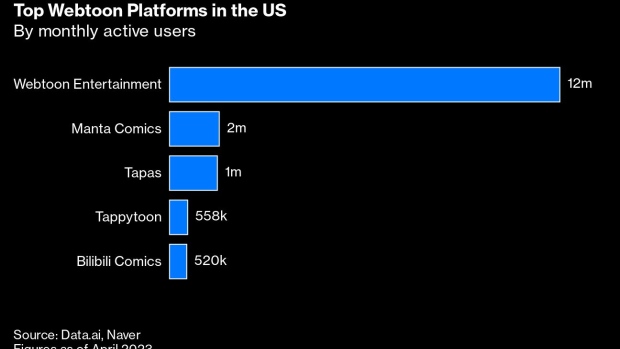

In North America, Naver is hoping to strengthen its so-called storytelling business — now based in Los Angeles — via its web cartoon unit and Wattpad. But the growing popularity of webtoons has in fact attracted deep-pocketed entrants such as Apple Inc. and Amazon.com Inc. The Naver content division’s growth is expected to slow to 12.9% in 2024, roughly a third of the growth it managed previously, Bloomberg Intelligence estimates.

Since emerging almost two decades ago, the webtoon medium has taken off with the proliferation of mobile devices. The platform made it easy for authors to release content that may not have appealed to traditional publishers, and helped them reach larger audiences. The medium has gained a reputation for producing content whose appeal stretches beyond the traditional comic book audience of young males.

©2024 Bloomberg L.P.