Mar 18, 2021

NFT frenzy buoys stocks, lifting auction houses and game makers

, Bloomberg News

Digital artist Beeple sells NFT for $69.3M

A grab bag of obscure stocks are soaring after unveiling plans to get involved in the exploding digital-art scene being powered by NFTs.

Non-fungible tokens, or NFTs, are cryptographic assets used on computer ledgers referred to as blockchains, similar to the network that powers bitcoin. They make it possible to track ownership and sales prices, as well as the number of copies in existence through each unique identifying code. They burst onto the mainstream consciousness last week when the artist Beeple’s “Everydays: the First 5,000 Days” sold for a record US$69 million.

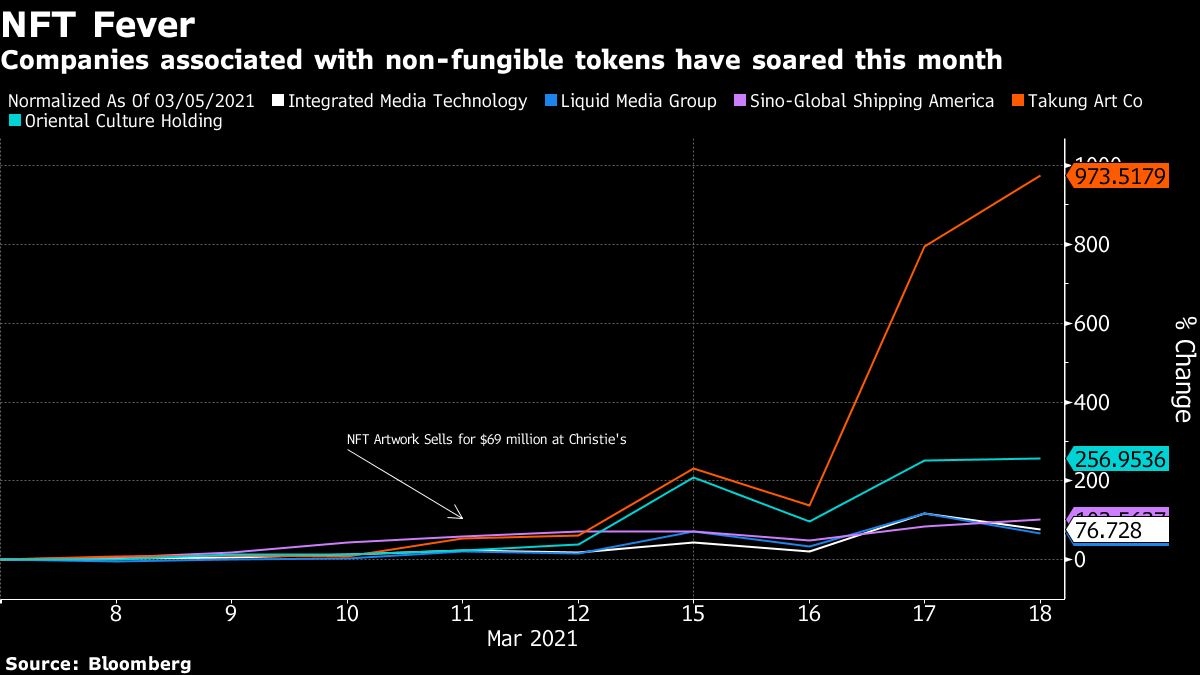

Takung Art Co., an online platform for artists to trade works, has gained around 900 per cent since the Christie’s auction. Oriental Culture Holdings Ltd., a marketplace to sell sculptures, collectibles and stamps, almost tripled.

Entertainment stocks such as video game company Liquid Media Group Inc., and virtual reality-focused Integrated Media Technology Ltd. have likewise rallied off potential to tap the NFT space. Liquid, which signed a distribution deal with Atari this month, more than doubled after Atari launched an NFT-enabled crypto casino and partnered with Bondly to create an NFT gaming platform last week. IMTE gained as much as 80 per cent this week as message volume around the company surged over 400 per cent on Stocktwits.

Other companies have taken a sharper turn to engage with NFTs. Sino-Global Shipping surged as much as 34 per cent after announcing it would collaborate with e-commerce public chain CyberMiles to launch an exchange for NFTs collectors, artists and investors to create and trade digital content.

The rush to invest in NFTs follows rallies seen in other hot stocks this year from pot stocks to EVs to bitcoin as retail investors jockey to cash in on the next big thing.