Apr 23, 2020

Oil edges higher on slower production in wake of sluggish demand

, Bloomberg News

Ottawa's oil and gas response is 'underwhelming' so far: Jim Davidson

Oil advanced as traders eye a production slowdown that has resulted from the coronavirus-led weaker demand environment.

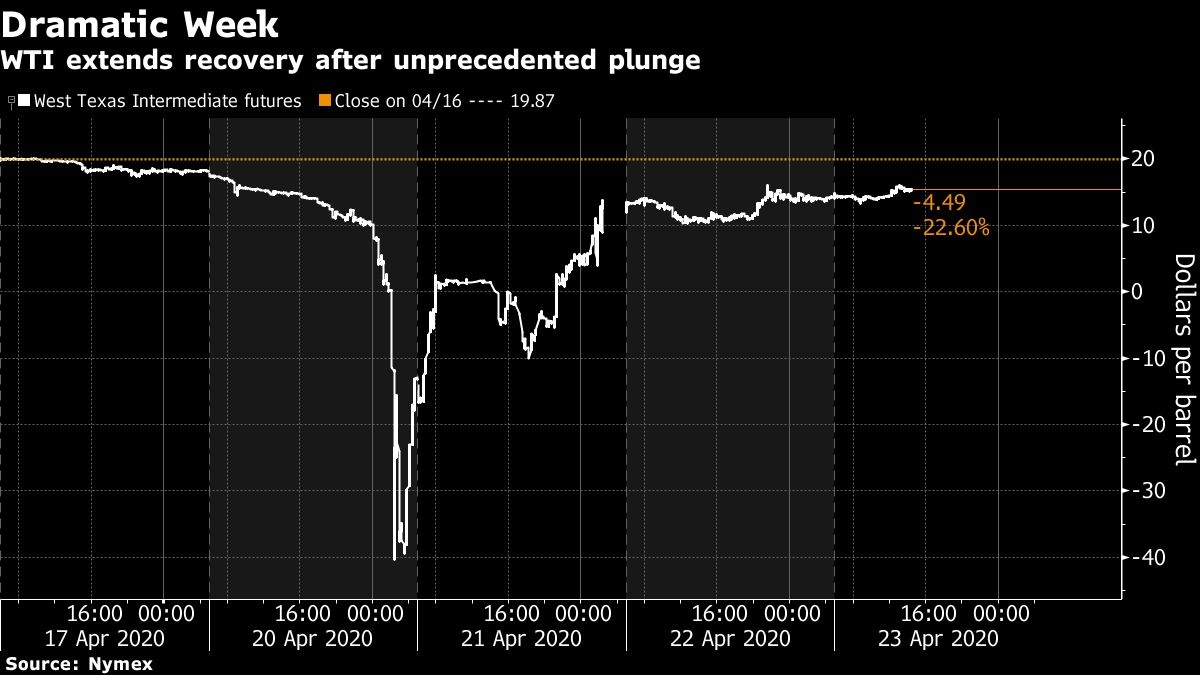

Futures gained 20 per cent in New York on Thursday. With crude trading below US$20-a-barrel, U.S. production has declined rapidly, now at the lowest since last July. Operators in the U.S. have also started to shut in old wells and halt new drilling, actions that could reduce output by 20 per cent. Plus, the number of new wells being brought online is forecast to plunge almost 90 per cent by the end of the year, according to IHS Markit Ltd.

“Cash market prices have recovered. There is a sense that the market is starting to clear itself,” said John Kilduff, a partner at hedge fund Again Capital LLC. The decline in production and rig count in the U.S. is “obviously supportive.”

OPEC and its allies have also reacted to the low-price environment. The coalition agreed earlier this month to slash daily production by about 10 million barrels a day starting in May. Iraq’s Oil Minister Thamir Ghadhban said oil prices will improve once the deal kicks off.

Kuwait said it has already started cutting output, the first major producer in the Persian Gulf, the world’s most prolific oil-producing region, to announce that it’s pumping less oil ahead of schedule. Algeria also told OPEC its cuts would begin immediately.

Prices:

- West Texas Intermediate crude for June delivery advanced US$2.72 to settle at US$16.50 a barrel on the New York Mercantile Exchange.

- WTI’s June-July spread rose US$1.97 to settle at -US$4.94 a barrel.

- Brent crude for June settlement climbed 96 cents to end the session at US$21.33 a barrel on the ICE Futures Europe exchange.

Still, the U.S. benchmark crude has plummeted more than 70 per cent so far this year as the coronavirus pandemic shutters economies and keeps drivers off the road. The World Bank says global commodities markets will face lasting disruption because of the outbreak.

Oil markets are also having to grapple with a wave of volatility spurred by exchange-traded funds. The United States Oil Fund may roll more of its WTI contracts forward due to extraordinary market conditions, while at least two brokerages, including INTL FCStone Financial Inc., are limiting the ability of some clients to enter into new trades in the most active oil benchmarks.

Even with production slowing, crude stockpiles in the U.S. are still at the highest level since May 2017, according to the Energy Information Administration. Inventories at the nation’s key storage hub in Cushing, Oklahoma, increased each week since early March and are inching closer to a maximum capacity of around 76 million barrels.

“Until we see some kind of resolution to the idea of how much demand is being destroyed from the COVID crisis, rallies will be short-lived,” said Gene McGillian, manager of market research at Tradition Energy.