May 19, 2021

Oil pares losses with broader market rally offsetting Iran talks

, Bloomberg News

Oil pared declines as positive U.S. labor market data offset the potential that a renewed nuclear deal with Iran will bring more barrels to the market.

Futures were down 1.3 per cent in New York after falling as much as 1.9 per cent earlier on Thursday. U.S. initial jobless claims fell last week to a fresh pandemic low, highlighting the labor market recovery underway in the world’s largest oil-consuming country. The S&P 500 Index gained, while the dollar weakened, boosting the appeal of commodities priced in the currency.

“The recovery in U.S. equities following jobs data and a weaker dollar” is helping support crude prices, said Phil Streible, chief market strategist at Blue Line Futures LLC in Chicago. Jobs data will “get a lot better, and with more people going back to work, it has a snowball effect of more driving.”

Still, the oil market hasn’t shaken off concern the Iran nuclear pact will be revived, which could see U.S. sanctions removed on the Persian Gulf country’s exports. President Hassan Rouhani struck an optimistic tone in comments released by Iranian state television, saying the deal would see oil, shipping, insurance and central bank sanctions lifted. But he said there are still some issues to be discussed, and his remarks largely echoed those from European Union officials on Wednesday.

The prospect of a return of supply from the OPEC member is being reflected in Brent’s prompt timespread, with its backwardation narrowing to just a few cents, a sign that market tightness may be easing.

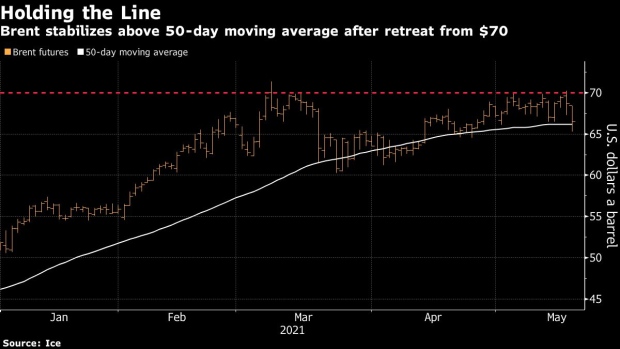

Brent has struggled to sustain a move higher after briefly topping US$70 a barrel earlier in the week. The market has been rattled by the outlook for Iranian production, though a timeline for a deal remains unclear. The Persian Gulf nation has already been boosting its exports ahead of a potential agreement, and India’s largest refiner said it will definitely restart buying Iranian oil once U.S. sanctions are lifted.

“There continue to be positive statements out of Vienna from various participants, including Iran, that a deal is at hand,” said John Kilduff, a partner at Again Capital LLC. “Even though we know they have already been ramping up their exports, it is adding to negative market sentiment.”

Prices:

- West Texas Intermediate for June, which expires Thursday, fell 59 cents to US$62.77 a barrel as of 10:20 a.m. in New York. The more-active July contract declined 61 cents to US$62.74

- Brent for July settlement lost 69 cents to US$65.97 a barrel

- Enrique Mora, the EU official in charge of coordinating diplomacy in Vienna for the nuclear talks, said he expects all parties to return to the 2015 agreement before Iran’s presidential elections on June 18. Citigroup Inc. sees an initial 500,000-barrel-a-day increase in supply from around the middle of the third quarter.

Meanwhile, volatility is creeping back into the market after a choppy week in which global benchmark futures have swung in a roughly US$5 range after topping the US$70-a-barrel mark. A measure of market volatility is at the highest since early April.

Other oil market news:

- In parts of Europe, highways are getting as busy as they were before the pandemic, offering a boost to the region’s oil demand.

- China’s Shenghong Group expects to start feeding crude into a new mega refining complex in Jiangsu this August.

- BP Plc has started a recruitment campaign for the people who will drive its expanding clean energy ambitions.