Jul 25, 2022

Oil rallies as tight supplies counter expectations of a slowdown

, Bloomberg News

Brent oil to reach US$85 by Q4: Citi's Ed Morse

Oil rose as tight near-term supplies outweighed expectations of another rate hike this week and an eventual economic slowdown.

West Texas Intermediate rose 2.1 per cent to settle above US$96 a barrel. The Federal Reserve is expected to increase interest rates this week to slow down economic growth. Despite the gloomier outlook, crude markets are pricing in remarkable strength for physical barrels with some buyers in Asia paying premiums of more than US$20 a barrel to secure certain crude grades. Nearby Brent futures are trading about US$5 over the next month’s contract, indicating refiners are willing to pay up to secure supplies.

“Crude prices are showing signs of stabilization around the mid-US$90s as the oil market still remains tight despite another wave of weakening economic data in the US and Europe,” said Ed Moya, senior market analyst at Oanda Corp. “Despite the growing risks of a severe recession, oil should see strong support at the US$90 level over the short-term.”

Crude is still up around 25 per cent for the year, although futures have given up most of the gains seen after Russia’s invasion of Ukraine in late February. The war has prompted many consumers to pivot away from Moscow, with Saudi Arabia and Iraq filling a large part of the gap in Europe. The US is championing a price cap on Russian crude to limit revenues flowing to the Kremlin to fund its invasion.

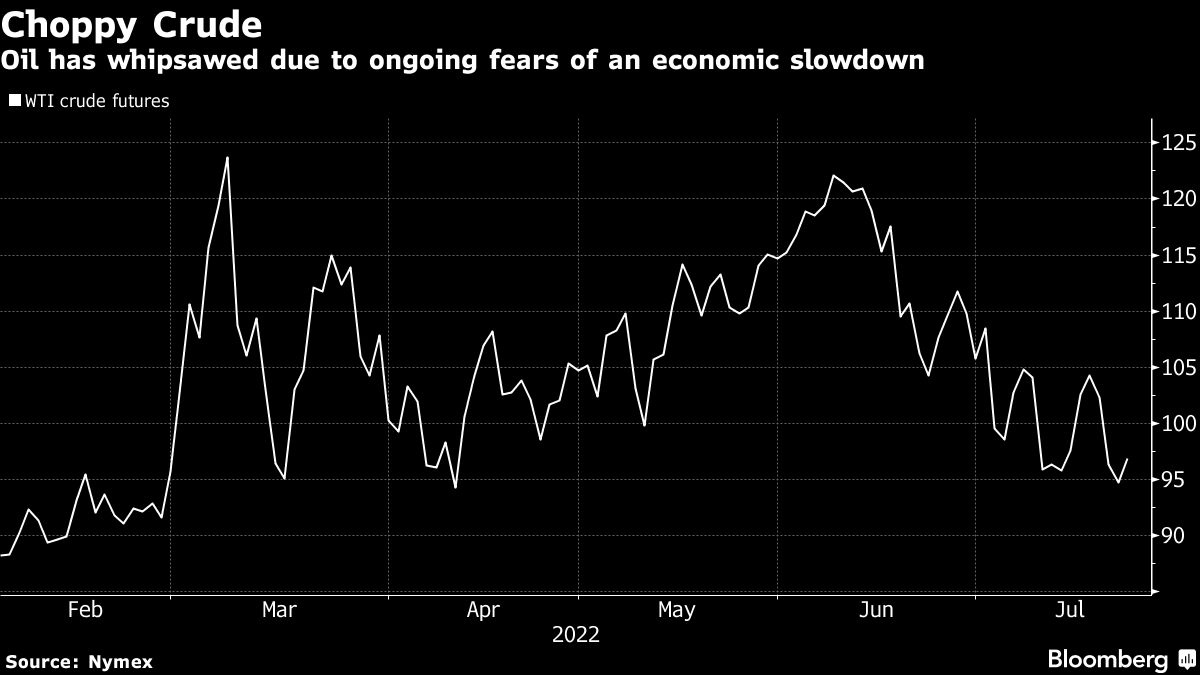

The oil market has experienced bouts of volatility, characterized by sharp swings and low liquidity, as investors juggle competing supply and demand outlooks.

“The key macro variable to watch for clues of future commodity price direction is core US inflation,” said Francisco Blanch, head of global commodities and derivatives research at Bank of America Corp. in a note to clients. “Should core surprise to the downside, a less aggressive tightening path could fuel a second round of commodity price inflation in 2023, although admittedly the reverse would also be true.”

Prices

- WTI for September delivery rose US$2.00 to settle at US$96.70 a barrel in New York.

- Brent for September settlement rose US$1.95 to settle at US$105.15 a barrel.

Meanwhile, a segment of the massive Keystone pipeline that delivers Canadian crude to the key US storage hub at Cushing restored normal operations late Friday following a power disruption. Service was still subject to mid-month capacity reductions, according to a bulletin obtained by Bloomberg. A prolonged slowdown in operations could have resulted in a supply squeeze to America’s largest crude stockpile.