Mar 26, 2019

Oil Rebounds as Growth Angst Eases and Venezuela Tensions Mount

, Bloomberg News

(Bloomberg) -- Oil rebounded along with global markets as pessimism over the global growth outlook eased a little, and rising tension in Venezuela threatened to further curb supplies from the holder of the world’s largest crude reserves.

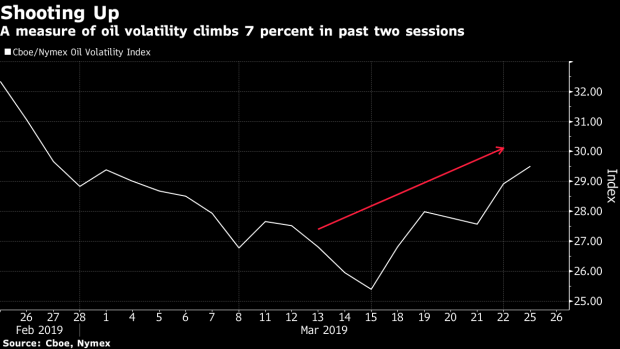

Futures in New York rose as much as 1 percent after falling about 2 percent over the last two sessions. U.S. Secretary of State Mike Pompeo on Monday warned Russia, which currently has around 100 soldiers in Venezuela as part of long-term military accords, not to intervene in the Latin American nation. A measure of oil volatility has spiked over the last two sessions as financial markets tumbled on fears the world economy will slow faster than expected.

Crude markers in New York and London have rallied more than 25 percent this year as the Organization of Petroleum Exporting Countries and its allies reaffirmed their commitment to curtail production. American sanctions on Iran and Venezuela have further squeezed supplies, while the slowing world economy and uncertainty over whether the U.S.-China trade war will be resolved are clouding the demand outlook.

“The outlook on global growth is shaking up investors, while prices are supported by the dwindling supplies coming out of OPEC,” said Howie Lee, a Singapore-based economist at Oversea-Chinese Banking Corp. Prices will likely stay volatile as “the tightening supply story is running out of steam,” he said.

West Texas Intermediate for May delivery rose 54 cents, or 0.9 percent, to $59.36 a barrel on the New York Mercantile Exchange as of 7:48 a.m. in London. It closed 0.4 percent lower on Monday after swinging between a 1.5 percent loss and an 0.5 percent gain earlier in the day.

Brent for May settlement advanced 0.4 percent to $67.50 a barrel on the London-based ICE Futures Europe exchange, rising for a second day. The global benchmark crude was at a premium of $8.12 to WTI.

The insertion of Russian military personnel into Venezuela to support Nicolas Maduro risks lengthening suffering there, Pompeo told his Russian counterpart, Sergei Lavrov, according to a U.S. State Department statement. The White House imposed sanctions on Venezuela’s state oil company earlier this year amid a standoff between Maduro and Juan Guaido, an opposition leader that the U.S. recognizes as Venezuela’s president.

An index of Asian stocks clawed back around half of Monday’s 1.9 percent drop and most of the region’s currencies rose as investors digested recession-risk signals from the U.S. that sparked declines in global markets on Friday and Monday. The Cboe/Nymex Oil Volatility Index rose 2 percent on Monday following a 4.9 percent jump in the previous session.

--With assistance from James Thornhill.

To contact the reporter on this story: Sharon Cho in Singapore at ccho28@bloomberg.net

To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net, Ovais Subhani

©2019 Bloomberg L.P.