Apr 12, 2020

Oil Reverses Early Gains as OPEC+ Deal Fails to Revive Prices

, Bloomberg News

(Bloomberg) -- Oil declined after an initial jump as an historic deal among the world’s top producers to cut global output by nearly a 10th failed to revive prices that have been pummeled by the coronavirus.

Futures in New York rose as much as 9% but quickly reversed those gains as markets opened following a three-day break. The OPEC+ alliance agreed to a plan to slash production by 9.7 million barrels a day starting in May, ending a price war between Saudi Arabia and Russia. The producer group reached a deal following days of intense negotiations after Mexico declined to endorse the original agreement reached Thursday.

The U.S., Brazil and Canada will contribute another 3.7 million barrels on paper as their production declines, and other Group of 20 nations will cut an additional 1.3 million. The G-20 numbers don’t represent real voluntary cuts, but rather reflect the impact that low prices have already had on output and would take months, or perhaps more than a year, to occur.

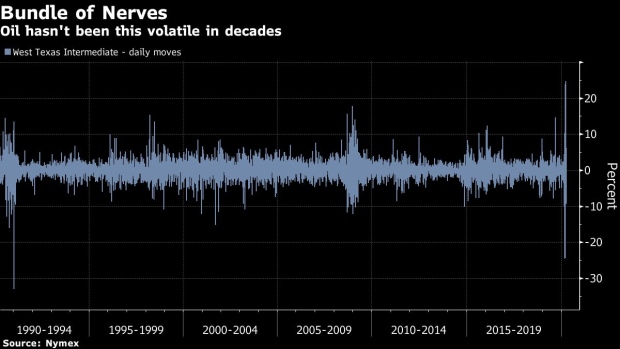

Oil prices have been in freefall since the middle of February as some of the world’s biggest economies went into lockdown to try and stop the spread of the coronavirus. The OPEC+ deal may not be enough to steady a market where demand losses may be as much as 35 million barrels a day and storage space is rapidly running out.

West Texas Intermediate for May delivery fell 1.4% to $22.44 a barrel on the New York Mercantile Exchange as of 6:15 a.m. in Singapore. The contract dropped almost 20% last week and has fallen from around $61 a barrel at the end of last year.

Brent for June delivery declined 0.3% to $31.28 a barrel on the ICE Futures Europe exchange after closing 4.1% lower on Thursday.

See also: The Secret Weapon Giving Mexico Power in the Oil-Price War

Mexico will reduce output by 100,000 barrels a day, after rejecting its 400,000 barrel-a-day share of the original deal. President Donald Trump helped broker a compromise that allows the Latin American nation to count some of the U.S. market-driven supply decline as its own.

Saudi Aramco once again delayed a key pricing decision in anticipation of final approval of the deal, with its official selling prices now expected on Monday.

The OPEC+ alliance initially met on Thursday via video conference. That was followed on Friday by a virtual gathering of G-20 energy ministers, who pledged to take “all the necessary measures” to maintain a balance between oil producers and consumers.

©2020 Bloomberg L.P.