Jan 8, 2024

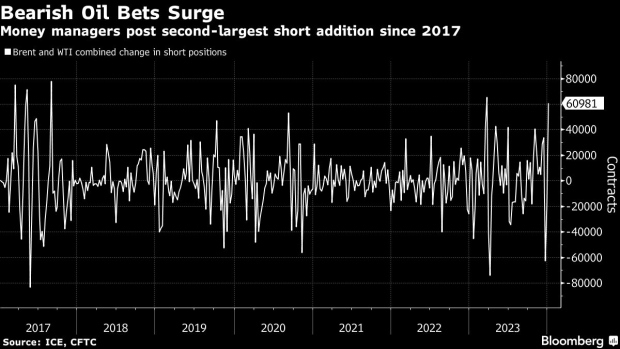

Oil Speculators Start Year With Huge Increase in Bearish Bets

, Bloomberg News

(Bloomberg) -- Money managers made one of their biggest bearish shifts on oil prices in years around the start of 2024.

Speculators added about 61,000 combined short positions in Brent and West Texas Intermediate crude in the week to Jan. 2, according to Intercontinental Exchange Inc. and Commodity Futures Trading Commission data. That’s the most since March and the second-largest increase since 2017.

Oil traders have begun 2024 on a relatively downbeat footing. Saudi Arabia cut its prices to all buyers for February — reflecting a weaker physical market — while Wall Street has been dialing back price outlooks for the year. Brent futures fell for the first time since 2020 last year amid better-than-expected supply.

Prices could come under further pressure this week as the annual rebalancing of the two biggest commodity indexes gets underway. Funds tracking the Bloomberg Commodity Index and the S&P GSCI index are likely to sell about 27,000 contracts of US crude futures worth roughly $2 billion, analysts at Citigroup Inc. estimate.

©2024 Bloomberg L.P.