Jul 20, 2022

Once-Unthinkable Nuclear Green Bonds Are Coming to Europe

, Bloomberg News

(Bloomberg) -- Europe’s green bond market is preparing to finance nuclear energy projects for the first time.

Electricite de France SA has updated its green financing framework to include nuclear after European Union lawmakers voted to give certain nuclear energy projects a sustainable label. A number of other companies are talking to investors about it, according to NatWest Markets Plc, one of the top 10 arrangers of environmental bond deals.

Even though nuclear has achieved green status on paper, thanks to low carbon emissions, it’s controversial and some ethical funds plan to continue boycotting it. EDF said it will distinguish between green bonds that finance nuclear and those that don’t, effectively creating two classes of debt to cater for the schism among investors.

“It’s likely we’ll see a European green bond that funds nuclear projects over the next 12 months, as well as green bonds where nuclear is one of multiple energy sources being financed,” said Arthur Krebbers, head of corporate climate and ESG capital markets at NatWest. “This isn’t a blank cheque for nuclear and gas -- there’s a granular list of environmental criteria and safeguards in place.”

The controversy surrounding the branding of nuclear power as green stems from concerns about waste disposal, the potential for weapons proliferation and the risk of accidental radiation. Historic nuclear catastrophes from Chernobyl to Three Mile Island and Fukushima makes expanding the energy source a harder sell.

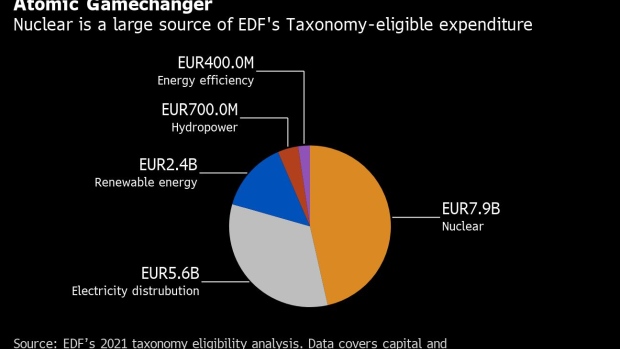

Its divisive status was reflected by EDF saying that proceeds of green bonds funding nuclear power shall be managed in a separate portfolio. Based on the company’s nuclear projects last year, about 8 billion euros ($8.2 billion) of spending could be eligible for green funding.

EU Lawmakers Remove Last Hurdle to Label Gas, Nuclear as Green

“We are taking into account certain investors who are not ready to invest in nuclear because of their internal policies,” an EDF spokesperson told Bloomberg. “They will always have the choice to invest only in ‘classic’ green bonds -- investing in renewables and hydro projects, for example -- if they wish.”

Any European issuers will look to follow the first successful sales across the Atlantic. Canadian utility Bruce Power LP sold what it said were the world’s debut green bonds for nuclear power last year, and that was followed by Ontario Power Generation Inc. earlier this month.

There should still be plenty of buyers. Around 60% of investors surveyed by Barclays Plc said they would be willing to buy green debt funding nuclear generation, though European respondents were the most reticent. Its appeal was bolstered this year by fears of a European energy crisis following Russia’s invasion of Ukraine.

EU Fractures Dream of Gold Standard for Green Market Investors

“We recognize the complexity around nuclear waste, safety and costs but are keen to explore all opportunities to enable net zero and therefore we take a cautiously positive view on nuclear as a bridge fuel,” said Scott Freedman, a London-based fund manager at Newton Investment Management.

Attitudes to the energy source differ by region -- reflected by EU member states clashing over its inclusion -- and are linked to decades of protests against nuclear weapons. A Natixis SA survey published last month found investors from Germany, Austria and Switzerland were especially unlikely to finance the sector as these countries have historically been opposed to atomic energy.

The £2.3 billion ($2.8 billion) Rathbone Ethical Bond Fund is among those blacklisting the energy source, seeing any possible benefits outweighed by longer-term risks. An EDF green bond that did not finance nuclear could be acceptable in principle, fund manager Bryn Jones said, though it would need to be assessed on its merits.

“We do not deny that nuclear power offers a low-carbon electricity source,” Jones said. “However, the climate crisis is not the only one which our world faces; biodiversity loss is another critical and often overlooked risk. We are not convinced of the ability to operate nuclear power plants and store waste for long periods of time while guaranteeing no significant impacts on the wider environment.”

©2022 Bloomberg L.P.