Aug 1, 2023

Pakistan to Roll Over Half of $24.5 Billion Maturing Debt

, Bloomberg News

(Bloomberg) -- Pakistan expects about half of its maturing debt in fiscal year 2024 to be rolled over, according to central bank Governor Jameel Ahmad.

About $11.3 billion out of the $24.5 billion of debt due this fiscal year will be rolled over, Ahmad said in an analyst briefing on Monday. Officials expect inflows to more than cover the rest of the financing requirement, he said.

“We are in a very comfortable position to meet our debt obligation as compared to a few weeks back,” Ahmad said in Karachi. The government paid $1.5 billion of debt in July, he said.

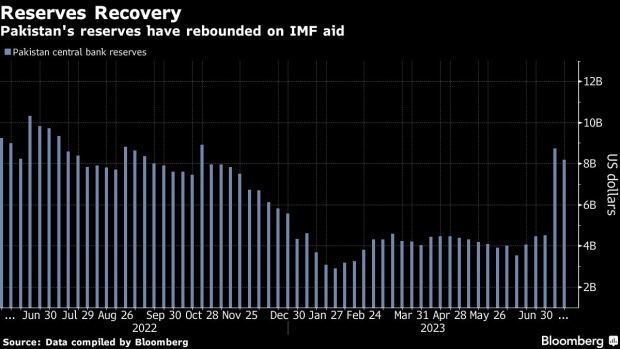

Pressure on Pakistan’s finances is easing after the nation secured a $3 billion bailout from the International Monetary Fund in July. That paved the way for billions of dollars of financing from creditor nations such as Saudi Arabia and the United Arab Emirates. The Gulf nations and China also agreed recently to extend debt payments on previous loans.

Pakistan’s foreign exchange reserves have almost doubled to $8.19 billion since the IMF loan.

Pakistan is in talks for a possible commercial borrowing and expects a sale of dollar bonds and sukuk debt at the end of the fiscal year. The central bank expects dollar bond yields to fall further, and foreign-exchange reserves to increase to more than $10 billion by June 2024, enough to cover two months of imports.

©2023 Bloomberg L.P.