Sep 30, 2020

Palantir debuts at US$17B value in long-awaited listing

, Bloomberg News

Palantir Technologies Inc. began trading Wednesday as a public company, ending a 17-year tradition of secrecy surrounding the software business co-founded by Peter Thiel.

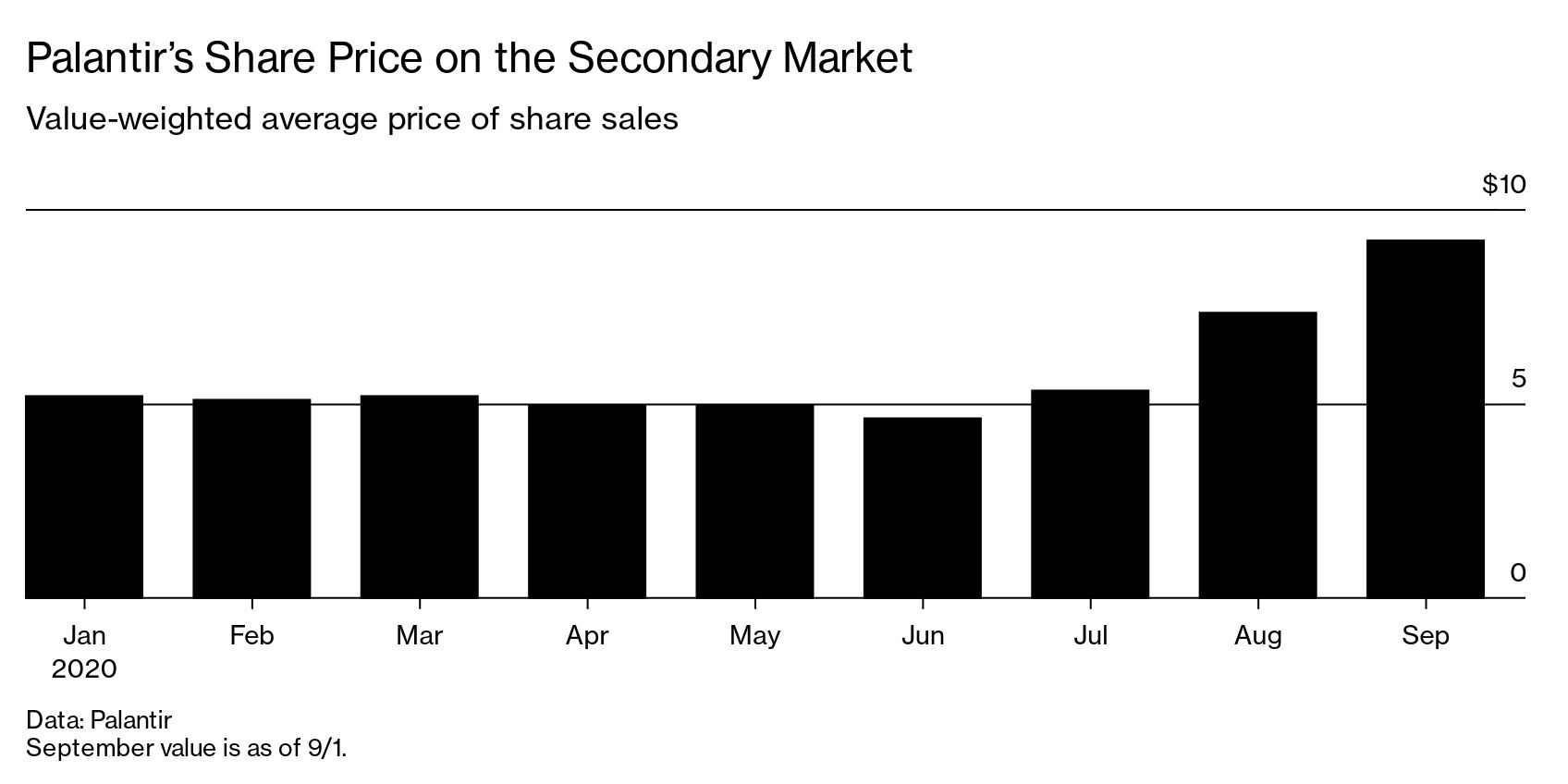

The data analytics company opened at US$10 on the New York Stock Exchange, above the reference price of US$7.25 that was set for the stock. Palantir listed its shares directly on the exchange, rather than raising capital through an initial public offering.

Palantir’s market value was about US$17 billion after the first trades. That’s a comedown from the US$20 billion valuation private investors had given Palantir since at least 2015.

Companies are racing to go public in the U.S. where investors are welcoming new stocks ahead of a presidential election likely to drive volatility. Companies raised US$61 billion from initial public offerings this quarter, the busiest on record, according to data compiled by Bloomberg. Software businesses were at the forefront of the listing boom, with Snowflake Inc. posting the biggest first-day pop in over a decade this month when it raised US$3.9 billion.

Wednesday was a particularly active day for direct listings, an unconventional mechanism for taking a company public. Asana Inc., another software company backed by Thiel’s venture capital firm Founders Fund, began trading at US$27.

Palantir traveled a long and sometimes rough road to its public debut. Thiel helped start the company in 2003 with early funding from an arm of the U.S. Central Intelligence Agency, but Palantir’s darling status among U.S. government agencies didn’t translate into success with businesses for well over a decade.

Named for the all-seeing stones in the fictional Lord of the Rings trilogy, Palantir combines myriad, ever-changing data streams into one centralized “source of truth.” Customers, including the U.S. Defense Department and pharmaceutical giant Merck KGaA, then mine that information and analyze it to make decisions. The results are presented as a series of spiderweb-like visuals, making information accessible to non-technical users.

For years, Palantir operated much like a consultancy, dispatching its engineers to customer sites to implement the software and build one-off applications. The model was expensive, and Palantir incurred heavy losses for most of its history. The business remains unprofitable.

When Palantir built a new software platform, Foundry, in 2016, the company cut costs by automating much of the grunt work and said it reduced time to set up customers from months to days. Palantir expects to deliver an adjusted profit this year on more than US$1 billion in revenue.

For Palantir, competition for global customers will be fierce. Palantir only began building a sales team in 2019. The company currently has about 125 customers, with the U.S. Army being the largest representing 15 per cent of revenue.

Palantir’s chairman, Thiel, and its work for government agencies including U.S. immigration have sparked concerns among corporate watchdogs and human rights groups including Amnesty International. The company has also drawn rebukes from governance experts who point out that Thiel will have power with little accountability because of multi-class stock that grants him outsize power in perpetuity.

Palantir followed other tech companies in its decision to bypass a traditional IPO. Slack Technologies Inc. and Spotify Technology SA went public through direct listings in recent years, allowing employees and other shareholders to sell stock without issuing new shares to raise capital. Each company’s stock soared with Slack and Spotify ending the first day of trading at valuations of US$19.5 billion and US$27.8 billion, respectively.