Dec 28, 2017

Paying down debt top financial priority for Canadians in 2018: Poll

, BNN Bloomberg

Paying down debt remains the top financial priority for Canadians amid climbing household debt and the expectation interest rates will rise next year, according to a new poll by CIBC.

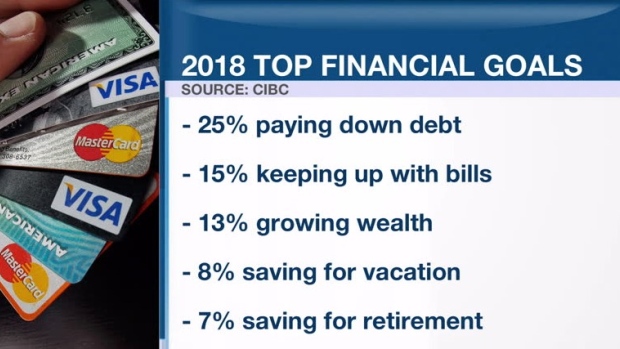

One-quarter of the 1,524 Canadians surveyed online between Dec. 11 and Dec. 12 said debt payment was their main focus heading into 2018, while some Canadians (13 per cent) will prioritize growing wealth, and seven per cent plan to focus on saving for retirement.

Over half surveyed in the poll released Thursday said they regret not paying down more debt before interest rates rise and only 16 per cent said they achieved their financial goals in 2017.

“While debt repayment is still the number one priority, Canadians recognize that it’s just as important to focus on building savings and growing your nest egg,” Jennifer Hubbard, managing director of financial planning and advice at CIBC said in a release.

“With inflation outpacing average earnings and the risk of outliving our assets, it’s essential to set out your short- and long-term financial goals in a comprehensive financial plan that strikes the right balance between paying down debt and growing savings.”

Just over one-quarter (26 per cent) of respondents said they took on new debt this past year in order to manage day-to-day expenses or deal with a financial emergency.

Going into the new year, two-thirds of Canadians (67 per cent) said they need a better handle on their finances, with 55 per cent planning to cut non-essential spending and over one-third intending to create a budget.

Additionally, twice as many people compared to last year’s survey said they will create an emergency fund and an automated savings planed.

Only nine per cent of Canadians said they don’t plan to set financial goals for the coming year.