Feb 21, 2018

Personal Investor: Mutual funds could hobble your RRSP

By Dale Jackson

If this year is like most, mutual funds will be the investment of choice for many registered retirement savings plan (RRSP) contributions. Approximately one-third of all RRSP assets are invested in mutual funds according to the Investment Funds Institute of Canada (IFIC). If you include mutual funds outside RRSPs and in company pension plans there is over $1.2 trillion invested in the thousands of mutual funds offered on the Canadian market.

Mutual funds have been the go-to RRSP contribution for decades because there are so few options for investors with modest portfolios to access a diversified basket of securities overseen by professional managers.

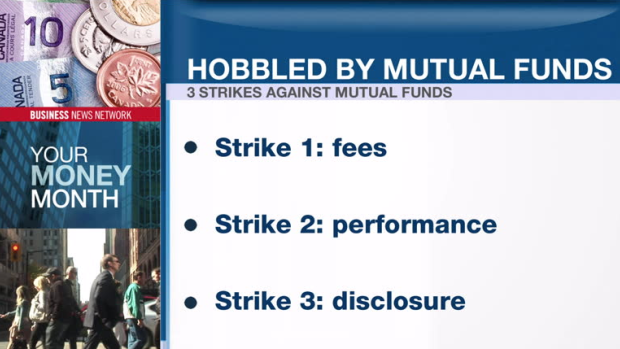

Professional risk management is the biggest selling point for the mutual fund industry but before the first dollar goes into a mutual fund there are already three strikes against the investor.

- Fees vary from fund to fund and company to company but most no-strings-attached funds charge an annual management expense ratio (MER) above two per cent. At the very least that’s an automatic two per cent off any gain for the year, or two per cent added to a loss. That two per cent could remove hundreds or even thousand dollars from your portfolio. Even worse, those hundreds or thousands of dollars will never be able to compound over the years – turning potential loses into the hundreds of thousands.

- Over time the average mutual fund underperforms its benchmark. As an example, the average Canadian equity mutual fund does not do as well as the TSX Composite Total Return Index. Curiously, the average mutual fund underperforms its benchmark by about the same amount as the MER – suggesting many fund managers merely mimic the index.

- Some mutual funds perform very well over long periods of time. Some perform very poorly. It’s hard to know a good fund from a bad fund because mutual fund companies are required to disclose so little about their funds. Investors can search independent fund websites like Globefund or Morningstar but information is often limited to past performance and a few top holdings. Mutual fund companies are not required to disclose all holdings and only periodically report on major changes in strategy or management. It may be months before you know of any major changes in your mutual fund.

There are options for investors including passively-managed exchange-traded funds (ETFs) or robo-advisors that make investment decisions based on an individual’s algorithms, but low-cost professional management can be elusive to investors with smaller portfolios. If you are invested in mutual funds talk to your advisor about bringing fees down – even if that means investing directly in the market.