Mar 19, 2024

Pimco Says BOJ Rate Hike Has Put Japanese Bonds Back on the Map

, Bloomberg News

(Bloomberg) -- The potential scale of the Bank of Japan’s policy shift may be more than some are expecting and lead to renewed interest in Japanese bonds from investors who might have previously shied away from the securities, according to Pacific Investment Management Co.

The central bank’s “policy evolution should usher in a period of normalization for Japanese bond markets, eventually attracting investors at higher yields who have been hesitant to invest over the past decade,” Tomoya Masanao, Pimco’s co-head of Japan and co-head of Asia-Pacific portfolio management, wrote in a report.

While the immediate impact of Tuesday’s historic rate hike may be minimal, the medium- to long-term effects could be “significant as the potential scale of the BOJ’s policy changes may be more than the financial markets currently anticipate,” he wrote.

Masanao’s view comes after the BOJ raised rates for the first time in 17 years, ending the most aggressive monetary stimulus program in modern history. His call reflects an expectation that resurgent inflation in Japan represents a structural shift in the labor market and corporate pricing behavior, and that the response of the BOJ should help put the country’s bond market on a more normal keel.

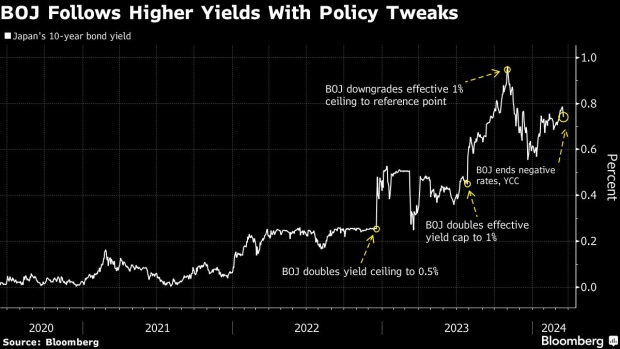

Yields on Japan’s 10-year benchmark bonds have more than doubled over the last 12 months as investors moved to price in a potential BOJ hike. But at around 0.73% they still significantly lag peers like Treasuries, which yield about 4.4%.

Ueda’s Fast Move Triggers Split on Whether BOJ Is Done Hiking

Market watchers are divided over how long it will take before the central bank opts for another hike.

Domestic flows into Japanese bond markets will rise, predicts Masanao, though he doesn’t expect a rapid repatriation of local investor holdings of foreign bonds.

“Japanese investors are generally underweight Japanese bonds and should consider increasing their allocations over time given higher yield levels,” he wrote.

BOJ’s Small Rate Hike May Have Big Ripple Effect Around the World

©2024 Bloomberg L.P.