Apr 4, 2022

Post-Brexit London Races to Keep Its Head-Start in Fintech

, Bloomberg News

(Bloomberg) -- At the 600-year-old Guildhall in the City of London, key players in a two-decade-old industry looking to remake finance are gathering.

Innovate Finance’s summit -- part of U.K. Fintech Week -- aims to showcase Britain’s financial technology sector and its global ambitions. Its profile has never been higher, with soaring demand from both customers and investors -- even if the latter are proving a little harder to find than in the U.S.

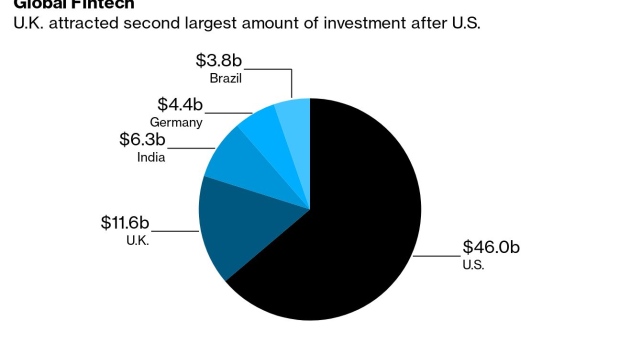

Investments in U.K. fintech companies more than tripled to $11.6 billion last year, according to figures published by Innovate Finance, a trade body for the industry. That’s not including the billions that more traditional banks and tech giants are splashing out to upgrade everything from current account apps to emerging uses for blockchain.

This week’s conference will discuss “what the U.K. needs to do to remain the world’s preeminent financial services and innovation hub in the coming years,” said Janine Hirt, chief executive officer of Innovate Finance.

The clock is ticking on this goal. Britain, where the wider finance sector makes up just under 10% of the economy, has some fintech success stories including Revolut Ltd., Monzo Bank Ltd. and OakNorth Bank that command multibillion-dollar valuations. However, few fintechs opt for London when it comes to selling shares on the stock market -- something the government is trying to change as it hunts for post-Brexit growth.

We take a dive into who’s shaking up the U.K. fintech landscape, the unicorns to look out for, and the gender funding gap.

The U.K. Picture

There are about 2,500 fintech companies in Britain, according to research by Deloitte. Most of these are based in London, which according to the accountancy firm is the third-biggest fintech hub in the world.

The term can apply to a wide range of businesses including online banks, technology to help apply regulations, price comparison websites and crypto exchanges.

British startups have attracted several blockbuster funding rounds in the past year.

- Revolut, valued at $33 billion in its last funding in July, has more than 18 million customers worldwide on its app that offers services including money transfers, savings and investments.

- In December, digital bank Monzo completed its biggest funding round of $600 million, valuing it at $4.5 billion.

- Copper.co, which helps financial institutions trade cryptocurrencies, has been in talks with investors to raise funds that would value it at around $3 billion.

- Checkout.com, which processes payments for retailers, in January announced new funding that valued the business at $40 billion. In 2021, the company tripled the volume of transactions processed -- for the third year in a row.

- Finance unicorn Starling Bank Ltd., whose backers include Goldman Sachs Group Inc., is looking for fresh funding a year after its last round, Bloomberg News has reported.

Almost all of the investment is flowing into London and the south east of England, though $696 million went to firms outside this region during last year, according to Innovate Finance. In turn, the U.K. dominates fintech funding across Europe, which itself pales in comparison to the U.S.

The British government thinks it can go further. One untapped source of funding for fast-growing companies is pension funds, which account for about 12% of the venture capital funding in Britain, compared with 65% in the U.S., according to a 2019 report from the British Business Bank.

Chris Philp, Britain’s minister for technology and the digital economy, said in a February interview that investors are “missing out on the returns opportunity provided by pre-IPO tech.” There’s also a challenge matching small, unknown companies to large investors who’d rather put cash into more established firms.

Late-stage funding also risks falling behind in Britain, which missed out on the craze for special purpose acquisition companies that brought a wave of firms to U.S. markets in the past few years. Money transfer platform Wise Plc achieved a direct listing in London, only to see its share price struggle since.

More than a third of privately funded U.K. fintechs expect to list within five years, according to figures from consultancy EY cited in last year’s Kalifa review. That review for the government recommended softening rules on areas such as founders’ stakes to entice fintechs to list here.

Another avenue for growth is collaboration with the so-called legacy banks. Consultancy EY and trade body Tech Nation launched a “fintech pledge” to increase the use of startups in the finance supply chain. All five major U.K. lenders have signed up.

There’s also still a long way to go for diversity. Kalifa’s report highlighted the importance of skills, access to global talent and strengthening the domestic pipeline to increase diversity and inclusion in the sector.

Seed stage companies across the U.K. technology industry have approximately 15% representation in the workforce of ethnic minority and other underrepresented communities, falling to 9% at more established firms, according to a report last year by trade body Tech Nation.

Women fintech founders in the U.K. receive 9% of all capital, and just 3% of venture capital funding goes to all-female teams, the report said. Entrepreneurs from Black, South Asian, East Asian and Middle Eastern backgrounds receive in total 1.7% of VC investment.

Room for Growth

It’s a sign that the upheaval promised by the industry is yet to come to pass. For Marieke Flament, change isn’t coming fast enough.

“While fintech was instrumental in improving financial services for consumers, it didn’t really disrupt things in a revolutionary way and the space has become very crowded and mainstream,” said Flament, the chief executive officer of the NEAR Foundation, a non-profit that oversees the development of a blockchain.

“Some are disillusioned by this and feel as though their work life is in mid-life crisis mode and they need to reboot,” she said.

The solution is for fintech itself to be disrupted, she says, arguing that web3 -- the catchall term for new online concepts including decentralized finance -- will be the opportunity for developers to “inject adrenaline” and “true disruption” into the industry.

©2022 Bloomberg L.P.