Oct 13, 2022

Pound, Gilts Surge as UK Officials Discuss U-Turn on Tax Cuts

, Bloomberg News

(Bloomberg) --

The pound surged the most in over two years, buoyed by reports that UK government officials are working on a U-turn of the sweeping tax cuts proposed by Prime Minister Liz Truss.

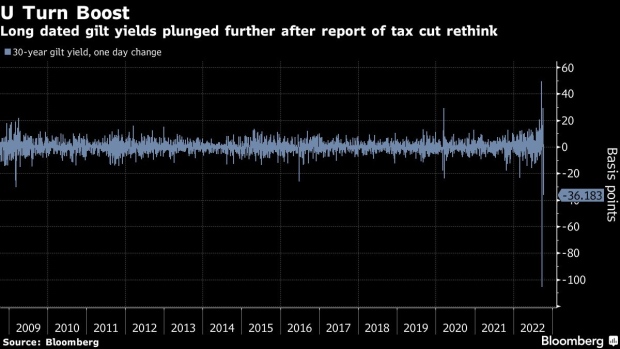

Sterling climbed as much as 2.4% to trade above $1.13, set to be the best-performing major currency this week as the dollar sags. UK bonds also rallied, with the yield on 30-year debt dropping as much as 46 basis points on bets fiscal changes would improve the country’s debt sustainability.

“Has the government finally heeded the calls from markets and the Bank of England? Price action in gilts and the pound suggests markets believe so,” said Simon Harvey, head of FX analysis at Monex Europe. If Truss does reverse her policy, “we are now finally looking at a potentially more fundamental basis for traders to turn bullish on the pound,” he added.

The sharp moves are the latest turbulence to hit UK markets since Chancellor of the Exchequer Kwasi Kwarteng unveiled a package of tax cuts last month that would likely strain public finances. Growing criticism from other lawmakers and waning support in voter polls has also been piling pressure on the government to make adjustments to policy.

UK officials at No. 10 and the Treasury are discussing how they can back down from the package of tax cuts, according to a person familiar with their conversations. The officials are drafting options for Truss but no final decision has been taken and they are waiting for Kwarteng to return to London from Washington, the person said, asking not to be identified commenting on private discussions.

The market recovery started on Wednesday after data showed the Bank of England had snapped up £4.56 billion ($5.2 billion) in long-dated and inflation-linked debt. It followed that up by buying a record £4.68 billion of assets Thursday, bringing the total purchases in the past two weeks to £17.8 billion.

BOE Buys Another £4.68 Billion of Bonds as End of Program Nears

Traders briefly priced in less than 100 basis points of hikes by the BOE at its next rate decision in November -- the first time that’s happened since the announcement of the mini-budget. They had been wagering on as much as 116 basis points earlier.

Markets are “feeling comforted by the relatively larger size that the BOE took down,” said Imogen Bachra, head of UK rates strategy at NatWest Markets.

Regardless of what happens to Truss’s policies, investors should still be wary of betting on the pound, according to Adam Cole, a strategist at RBC Capital Markets. He said that he would be looking to sell the currency above $1.13.

(Updates prices.)

©2022 Bloomberg L.P.