Oct 12, 2022

Pound Reverses Loss on Report BOE to Extend Bond Purchases

, Bloomberg News

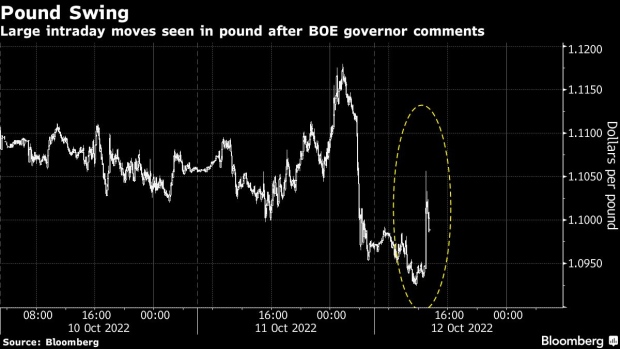

(Bloomberg) -- The pound swung to a gain after a Financial Times report appeared to walk back comments from Bank of England Governor Andrew Bailey, who had said the central bank is set to halt its market support this week.

The British currency reversed a loss of as much as 0.4% to trade 0.2% higher in early London trading. The BOE had signaled privately to bankers it could extend a bond-buying program past Friday’s deadline, the FT said, though it was unclear from the report when that guidance was given.

Bailey told pension funds Tuesday they have just “three days left” to sort out their liquidity positions before emergency bond purchases will be halted. His comments came after UK debt markets closed but sent Treasury yields spiking and the sterling to a two-week low.

Bailey Puts BOE Credibility on Line With Vow to End Gilt Buying

“The pound has found some relief on the report of a reprieve for the gilt market but sterling is likely to remain fragile given that Governor Bailey was very clear that the program is temporary,” said Sean Callow, senior currency strategist at Westpac Banking Corp. in Sydney. “Sterling still looks like a sell on rallies against a solid dollar, heading back to $1.08 and below in coming sessions.”

The signaling whiplash left gilts set for another volatile session. The BOE’s unlimited debt purchase plan announced on Sept. 28 had spurred a turnaround in the market, but the benchmark 10-year note has almost erased gains since then.

According to the FT, the BOE will decide whether or not to extend the facility on Thursday or Friday. The central bank is assessing whether affected liability-driven investment managers have built up enough cash reserves to meet margin calls, the newspaper said.

“It would have been better that the BOE continued the support measure,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. in Tokyo. “The 10-year gilt yield could rise to 5% as early as this month” from 4.44% on Tuesday, he said.

The dollar had strengthened against the pound and other major currencies on Wednesday before the report as renewed concern over a UK asset selloff fueled demand for the haven asset.

If the BOE “did commit the expiration date of Friday, the pound bears will have their way,” said Simon Harvey, head of FX analysis at Monex Europe. “Their hard stance on taking away the support mechanism is doing the pound no favors.”

©2022 Bloomberg L.P.