Oct 28, 2022

Private Lender Cuts Canada Mortgage Business as Defaults Rise

, Bloomberg News

(Bloomberg) -- Real estate lender Romspen Investment Corp. has cut back on its dealmaking in Canada after rising interest rates caused a spike in non-performing loans.

The firm, backed by New York-based TIG Advisors, is acting “defensively” to match the current economic environment in the country, Romspen Managing Partner Derek Jenkin said in an interview. “We’re being very selective in what we finance at this time in Canada.”

The nation’s real estate market has been disrupted by the Bank of Canada’s aggressive rate increases, rich housing valuations and rising commercial vacancies in some cities, including Toronto. The central bank hiked again on Wednesday, boosting the overnight lending rate to 3.75%, the highest in the Group of Seven, and signaled that more increases are coming.

“When you have such a sharp, fast interest rate move, that creates a bit of an air pocket in the market, and the market requires a little bit of time to adjust,” Jenkin said.

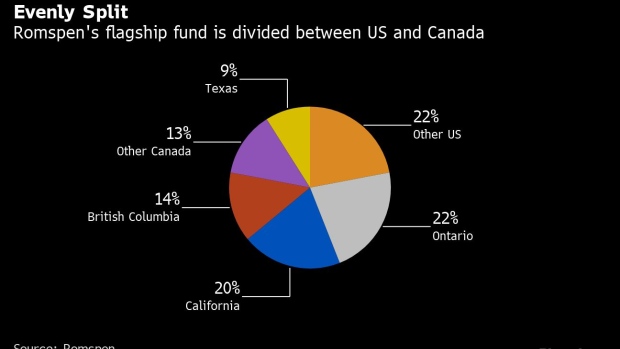

Romspen is one of Canada’s largest specialty managers of private mortgage funds, providing pre-development, construction and other loans for commercial and residential projects. As of June 30, the assets of its flagship Romspen Mortgage Investment Fund were divided almost evenly between Canadian and US loans.

Almost all of its loans have terms of two years or less, but the number of borrowers that stopped making interest payments spiked in recent months. Non-performing loans are in the “ballpark” of 40%, Jenkin said, above the fund’s typical range of 20% to 25%.

When developers can’t catch up on their payments, Romspen forecloses and deploys teams to continue work on projects before selling them. Because it lends at 65% loan-to-value, “the market would have to move by about 30% for us to see any material loss in our book,” Jenkin said.

Financial stress for developers has forced Romspen to limit the cash investors can pull from the flagship fund.

“The fund has honored over C$700 million of redemptions over the past 18 months,” the firm told unitholders in a letter last month. “But with the above market dislocations causing delays in converting mortgage assets to cash, this level is simply not sustainable in the near term,” The fund had C$2.8 billion ($2.1 billion) invested in 134 mortgages at the end of June.

‘Ripple Effect’

To preserve liquidity, the firm created a “runoff pool” for investors who want to get their money out; Romspen will funnel cash to that vehicle as loans are repaid or properties are sold. It’s a similar approach to the one it adopted during the early months of the pandemic and the 2008 financial crisis.

The sudden rise in rates this year appears to be a less dramatic event than those two episodes, Jenkin said. But it’s slowing things down. Real estate deals will take many months longer to close, creating a “ripple effect” for developers and lenders, Jenkin said. Romspen’s borrowers have sought to increase their loan amounts up to the negotiated ceiling so they can continue their projects, he said.

There’s less “dysfunction” in the US and there was no redemption queue in the firm’s smaller US mortgage fund, Jenkin added. That product is focused on delivering short-term loans to real estate developers, with about of half the fund lent to projects in Florida and Texas.

Romspen’s mortgage operations have posted only one monthly negative return, in 1995. Annualized returns were 7.4% in the past 25 years.

The firm expects to raise $500 million in the next two to three quarters from investors in the Middle East, Europe and Asia for its US vehicle, and targets raising C$200 million to C$250 million for the flagship fund.

--With assistance from Kevin Orland.

©2022 Bloomberg L.P.