Sep 5, 2023

Pump Prices in US Hit Highest Seasonal Level in Over a Decade

, Bloomberg News

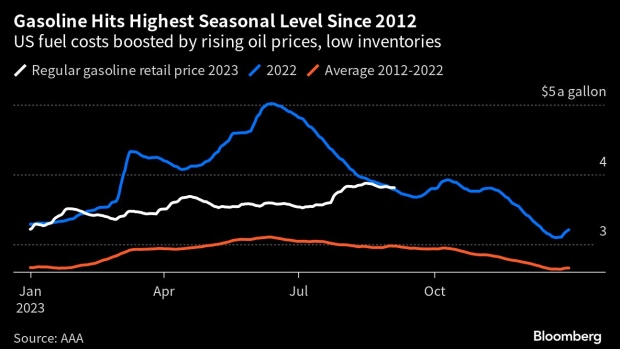

(Bloomberg) -- Gasoline prices are now at the highest seasonal level in more than a decade even as the Labor Day holiday marked the end of the US summer driving season, sparking fears that inflation could accelerate again in a challenge to President Joe Biden’s reelection efforts.

The national average for regular gasoline stands at $3.811 a gallon, topping this time last year and marking the second-highest level in records going back to 1994 from the American Automobile Association. The move comes in a period when prices typically decline going into fall and is a u-turn after a relatively cheap summer for drivers.

Relief at the pump is complicated by a resurgence in the cost of oil, with Brent futures topping $90 a barrel on Tuesday after Saudi Arabia and Russia extended production cuts that have already tightened global supply. Both the global benchmark and West Texas Intermediate futures are at the highest level since November.

Expensive fuel poses a risk to Biden as it’s one of the most visible signs of inflation. The president is “doing everything within his toolkit to be able to get lower prices for consumers at the gas pump,” National Security Advisor Jake Sullivan said at a White House briefing Tuesday, adding that gasoline prices are an “ultimate metric” for success.

Last year in the wake of Russia’s invasion of Ukraine, the Biden administration resorted to selling an unprecedented amount of oil from the Strategic Petroleum Reserve when record pump prices helped push inflation to a 40-year high. Now, the administration is in the process of buying back crude to refill the emergency caverns, which have drained close to their lowest level in four decades.

Read More: Why Are US Gas Prices Going Up? When Will They Fall? QuickTake

Fuel markets have also been squeezed with US national stockpiles staying largely below seasonal norms since around mid-July. Supply is unlikely to rebuild soon with refineries entering the fall maintenance season, but the decline in demand should provide some balance.

--With assistance from Jenny Leonard and Michelle Jamrisko.

(Adds comments from Jake Sullivan starting in fourth paragraph and details of emergency reserve sales in fifth paragraph.)

©2023 Bloomberg L.P.