Bankers Doing Bond Deals Caught Out by New Era of Issuer Clauses

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Joe Biden’s allies are racing to blunt the presidential campaign of Robert F. Kennedy Jr., casting his third-party effort as a stalking-horse bid designed to boost Donald Trump’s chances — even as his wide-ranging policy positions make him a threat to both.

Chengdu, a major city in the southwest China, removed home-buying curbs, joining dozens of peers in the country in an attempt to revive real estate demand and boost economic growth.

China Vanke Co. made a rare response to Moody’s downgrade last week, citing support from financial institutions and its biggest shareholder.

Billionaires who built their fortunes rolling out wireless networks when debt cost almost nothing are seeing their wealth crimped by higher borrowing costs and caution among money managers on the outlook for the industry.

Jan 27, 2022

, BNN Bloomberg

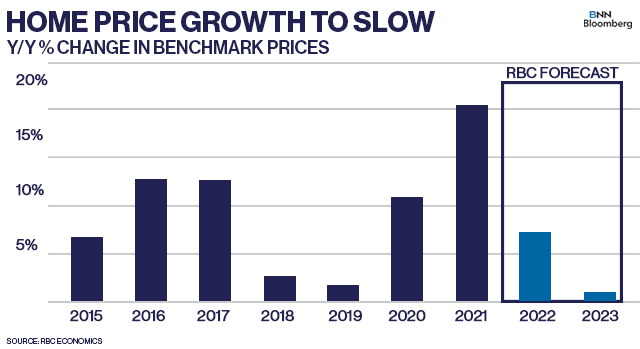

A new report from RBC Economics says the meteoric surge in home prices will start to slow as the Bank of Canada embarks on its rate-hiking campaign. However, homebuyers should still expect affordability to be stretched.

The report forecasts home prices will rise 6.2 per cent this year – a big slowdown from last year’s 17.8 per cent gain – as higher rates and the potential implementation of new anti-speculation measures sideline some end-user buyers and real estate investors.

RBC Senior Economist Robert Hogue estimates national home sales will total 579,000 this year – a number that’s down roughly 13 per cent from 2021, but still the second-highest amount on record.

“Most of that increase in supply and cooling of the market will take place in the second half of this year,” Hogue said in the report on Thursday.

“We expect demand-supply conditions to become much less favourable – though still broadly positive – for sellers by then, reducing upward pressure on prices.”

RBC predicts the Bank of Canada will deliver six interest rate increases by mid-2023, bringing the overnight rate to 1.75 per cent.

Hogue warned buyers could see home prices continue to soar in particularly tight markets such as Vancouver and Toronto in the near term. But as higher rates ripple through the economy, those markets will likely feel an outsized impact of rising rates, he added, because homeowners in those markets tend to have larger mortgage loans and higher monthly mortgage payments.

Hogue pins any significant improvements in housing affordability on supply.

“So far in the pandemic, supply has been dwarfed by supercharged demand. Inventories of homes for sale have plummeted to historical lows as a result, leaving few options for buyers,” he said.

He estimates there was a national housing shortage of 180,000 to as many as 250,000 properties at the end of last year, and said the number of homes listed for sale would likely need to triple before we reach a better balance in the market.

Without more supply, bidding wars are likely to continue — even in smaller markets, according to Hogue.

“Housing starts have surged in the last year, reaching levels unseen since the mid-1970s,” he said. “The increase is unlikely to fully address the supply shortage on its own. But alongside calmer demand, we believe it will noticeably reduce the imbalance.”