Feb 26, 2024

RBNZ Seen Holding Rates Steady While Retaining Threat to Hike

, Bloomberg News

(Bloomberg) -- New Zealand’s central bank will probably keep interest rates on hold this week but retain the threat of a hike as inflation proves difficult to tame, economists said.

The Reserve Bank’s Monetary Policy Committee will hold the Official Cash Rate at 5.5% Wednesday in Wellington, according to 22 of 24 economists in a Bloomberg survey. Two forecasters — ANZ Bank and TD Securities — predict an increase to 5.75%.

“We are firmly of the view that recent data shows monetary policy is having the desired effect,” said Kim Mundy, senior economist at ASB Bank in Auckland. “But we acknowledge there are still some pockets of sticky inflation in the economy.”

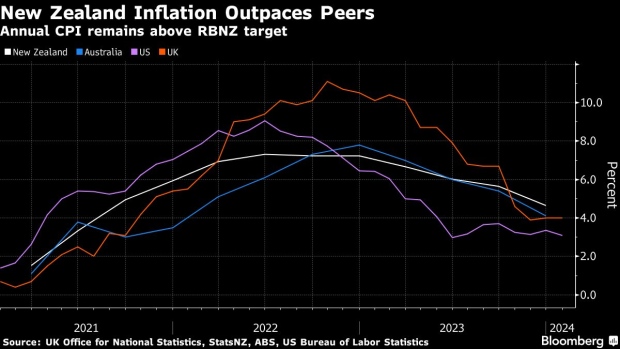

Policymakers around the world have been pushing back against bets that rate cuts are imminent, saying they want to be sure price pressures are contained. The RBNZ has gone a step further, flagging the risk of further tightening. New Zealand’s inflation rate of 4.7% remains well above the 1-3% target band and higher than many of its peers.

The RBNZ releases its rate decision, the first of the year, at 2 p.m. local time and Governor Adrian Orr will hold a press conference an hour later.

The bank will also publish an updated forward track for the OCR. Most economists expect little change from the previous track in November, which showed the chance of a rate increase this year and no cuts until 2025.

Investors are pricing a 25% chance of a rate hike tomorrow, swaps data show. The cash rate has been on hold since May last year.

‘Riskier Option’

Sharon Zollner, chief New Zealand economist at ANZ in Auckland, predicts the RBNZ will resume policy tightening because inflation has been stronger than it expected, even though the economy is weaker.

“Hiking the OCR into a weaker economy is of course risky, but our expectation is that the RBNZ will conclude that not hiking is the riskier option,” she said. “If the Committee does in fact decide they need more evidence that a higher OCR is required before acting, we would nonetheless expect an extremely hawkish tone and an OCR track that sets a low bar for a hike in April.”

RBNZ policymakers have sounded hawkish in recent weeks. Chief economist Paul Conway said last month that the bank still has “a way to go” to get inflation back to its 2% goal, while Orr said Feb. 16 it has “more work to do” to anchor inflation expectations.

A survey of households published by the RBNZ last week showed the median two-year ahead inflation expectation has risen to 3.2% from 3%, while the five-year expectation jumped to 3% from 2%. That prompted TD Securities to change its forecast of no further RBNZ rate increases to two more hikes.

New Zealand’s population is growing at the fastest pace since the end of World War Two, driven by record immigration. That may add to demand and fuel price pressures. And while the labor market is cooling, the unemployment rate, currently at 4%, isn’t rising as quickly as expected, which could keep more upward pressure on wages than the RBNZ would like.

Still, the economy is cooling faster than anticipated. Gross domestic product unexpectedly contracted in the third quarter of 2023 and the national statistics agency revised down previous GDP readings.

“We can fully understand why the RBNZ might want to forcefully push back on the idea of cuts,” said Doug Steel, senior economist at Bank of New Zealand in Wellington. “It’s the thought of hikes that bothers us. Monetary conditions are already tight and doing their work.”

ASB’s Mundy said the RBNZ won’t stop flagging the risks of more rate hikes until it sees a broad cooling in inflation pressures and more progress in labor market data.

However, “we don’t think the RBNZ needs to lift the OCR further unless inflation starts to accelerate again,” she said. “Instead, keeping rates at these current restrictive levels for enough time should extinguish the hot spots.”

©2024 Bloomberg L.P.