Feb 17, 2022

Refiners in Oil’s Top Market Want More - Even Near $100 a Barrel

, Bloomberg News

(Bloomberg) -- Oil soaring to near $100 a barrel is doing little to slow down demand from the biggest buyers as refineries in Asia look to boost processing rates to cash in on a boom in fuel-making profits.

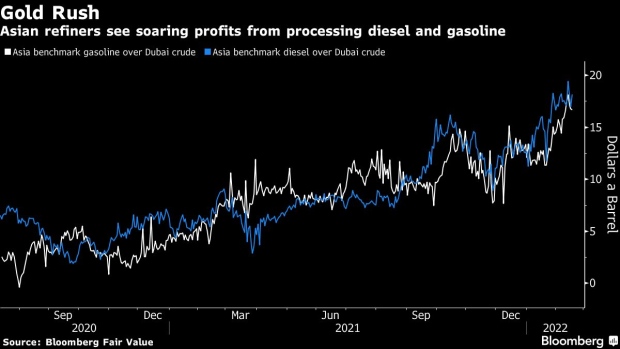

Despite rising crude prices, margins for producing diesel and gasoline have surged to near pre-pandemic levels as inventories run low across the world. A significantly reduced stream of Chinese fuel exports in recent months has left Asia shorter on supply and more sensitive to disruptions as consumption recovers with countries easing virus restrictions.

See also: Oil’s Spectacular Covid Crash Set the World Up for $100 Crude

That means demand for oil continues to be strong in the world’s biggest consuming region even as prices climb to the highest in seven years, adding to inflationary pressure that’s hurting consumers and putting pressure on governments and central banks all over the world.

“Refiners that are not limited by turnarounds will be looking to run processing higher,” said Daphne Ho, an analyst with Wood Mackenzie Ltd. Fuel is likely to remain in short supply through March and April, she added.

In India, state-run processors have been seeking to buy more crude for March and April, with at least 18 of its 23 refineries operating above nameplate capacity in January. Reliance Industries Ltd., the country’s second biggest refiner, deferred maintenance at one of its crude units at the Jamnagar refining complex by six months to capitalize on the high fuel margins.

South Korea’s largest oil refiner SK Innovation Co. plans to raise utilization rates at its Ulsan refinery to an average of 85% in the first three months of the year, up from 68% in the previous quarter amid a strong gasoline market, a company spokeswoman said by phone. It will run a gasoline-producing unit at full capacity while its crude distillation tower shuts for planned maintenance, so there will be little impact on its fuel output, she said.

In Taiwan, the strength in the gasoline market means CPC Corp. is set to further raise processing rates, which are currently above 90% at Dalin and more than 80% at Taoyuan, a company official said by phone. “It’s natural refiners will be wanting to run as high as possible,” he said.

Processing rates at Taiwan’s largest refiner Formosa Petrochemical Corp. will be constrained as the company carries out planned maintenance work through April, on top of an earlier fire at a coking unit disrupting operations until March. The company plans to raise operating rates in Mailiao in May, said spokesperson Lin Keh-Yeh, citing strong refining margins.

“The margins are very good right now,” Lin said. “We expect that in the first half of the year, the margins could sustain,” as several refineries in Asia will be undertaking scheduled maintenance in the second quarter, he said.

By comparison, any increase in refinery utilization rates in Europe is likely to be limited due to high natural gas and carbon costs. Spring maintenance in the U.S. is likely to drive lower refinery availability as well, Wood Mackenzie’s Ho said.

©2022 Bloomberg L.P.