Jul 28, 2022

Rents Are Out of Reach for Minimum-Wage Workers Toiling 40 Hours a Week

, Bloomberg News

(Bloomberg) -- Affordable housing is becoming more and more precarious as rents keep climbing at a record pace, and wages for many Americans aren’t keeping up with inflation.

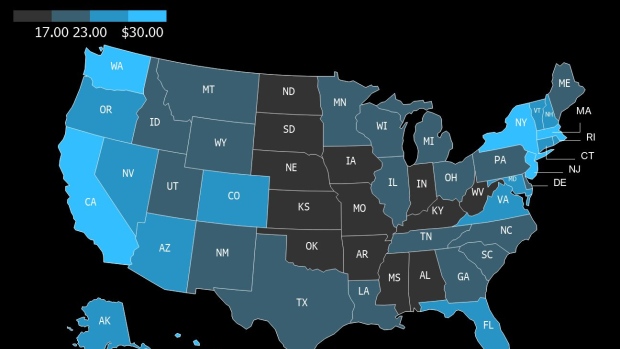

The average worker on a 40-hour week would need to earn $21.25 an hour to afford a one-bedroom home in the US, and $25.82 to afford a two-bedroom home, according to a new report from the National Low Income Housing Coalition, an advocacy group. In every state in the US, the cost to rent a home exceeds their minimum wage.

In Arkansas, for instance, workers would need to earn $14.89 an hour to afford a two-bedroom home, but the state doesn’t have a minimum-wage law, so its workers make the federal minimum wage of $7.25.

Even while California and other states across the country have raised minimum wages, “The cost of housing continues to far outpace income growth,” said Representative Maxine Waters, a Democrat from California and the Chairwoman of the US House Committee on Financial Services. “It is unconscionable for this country, with the resources that it has, to ignore the housing crisis in America.”

Waters noted that California’s $15 minimum wage is only half of what a person would need to afford a one-bedroom apartment. Workers would need to earn $39.01 an hour for a two-bedroom. Seven of the 10 metropolitan areas with the most expensive housing wage for a two-bedroom apartment are in California.

Eighty-six percent of extremely low-income renters are cost-burdened, and 72% of extremely low-income renters are severely cost-burdened, the report also said. Households are considered housing cost-burdened if they spend more than 30% of their income on rent and utilities.

While rent remains financially out of reach for many Americans, it is still more affordable to rent than buy a home.

©2022 Bloomberg L.P.