Apr 11, 2022

Russia Added Yuan, Euro to Reserves Before War, Cut Dollar Share

, Bloomberg News

(Bloomberg) -- Russia has enough holdings in yuan and gold even after the U.S. and its allies imposed sanctions on its reserves in dollars and other currencies, Bank of Russia Governor Elvira Nabiullina said in her annual report to parliament Monday.

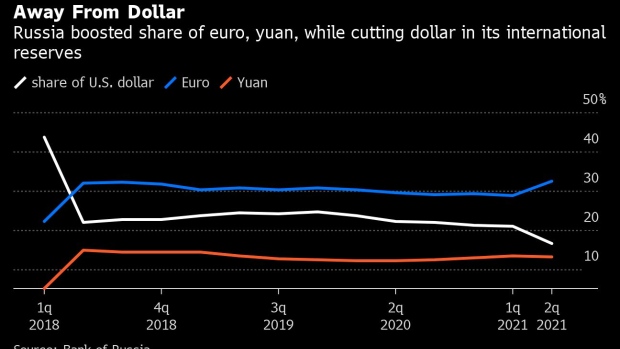

Continuing a multi-year effort to reduce exposure to the U.S. currency, the central bank cut the share of dollars in reserves to 10.9% as of Jan. 1 from from 21.2% a year earlier. But euro holdings rose to 33.9% from 29.2%, the central bank said.

Yuan holdings rose to 17.1% from 12.8% a year earlier, while gold was down slight at 21.5%.

The U.S. and its allies imposed sweeping sanctions on Russia following its Feb. 24 invasion of Ukraine, including limits on the central bank’s reserves. Russian officials said the restrictions froze about half of its $642 billion in reserves.

“This extraordinary, shock situation will lead to large-scale changes,” Nabiullina said in her report. “The difficult process of adapting to the new conditions will inevitably lead to a contraction in GDP but the Russian economy will be able to return to a growth trajectory.”

©2022 Bloomberg L.P.