Apr 5, 2022

Russia Five-Year Default Risk Jumps to 87.7% After U.S. Ban

, Bloomberg News

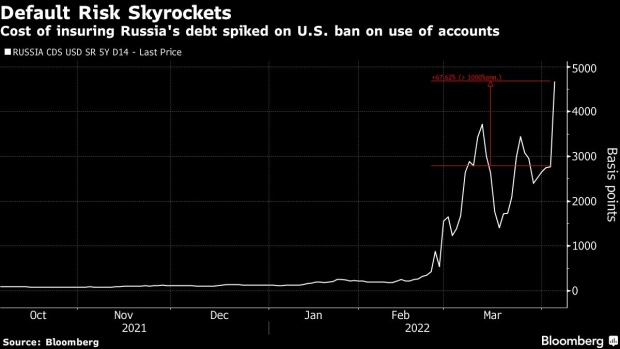

(Bloomberg) -- The price of insuring Russia’s debt against default jumped on Tuesday signaling an 87.7% chance that the country will miss its debt obligations within five years, according to CMA, part of ICE Data Services.

The probability of default rose from 77.7% on Monday after the Treasury decided to halt dollar debt payments from U.S. bank accounts, and is up from 24.1% when the invasion of Ukraine started on Feb. 24, the data show.

Russia has been able to service its debt even under sanctions as the U.S. made an exception, valid until late May, for creditors to receive interest. The tightening of the restrictions on payment from U.S. banks, however, adds pressure on Moscow to find new routes to remain current on its debt obligations. Some holders of a 2042 bond with coupons coming due on Monday hadn’t received payments as of Tuesday morning in London.

The halt on using cash from U.S. banks is intended to force Russia into draining its domestic dollar reserves, spending new revenue to make bond payments or going into default, a spokesperson for the Treasury’s Office of Foreign Assets Control said.

©2022 Bloomberg L.P.