May 9, 2022

Russian Crude Keeps Flowing While Europe Wrangles Over Sanctions

, Bloomberg News

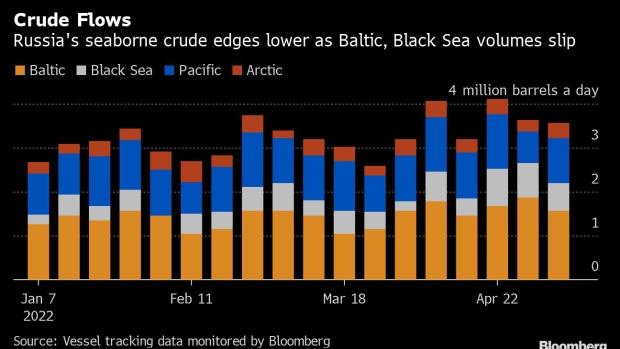

(Bloomberg) -- Russia’s seaborne crude exports continue to flow while European Union nations wrangle over sanctions to block purchases and make it harder for the country to ship its barrels elsewhere.

Shipments of the nation’s crude were little changed in the seven days to May 6 compared with the previous week, even as the volume sent to Asia from Russia’s western ports tumbled.

A total of 34 tankers loaded about 24.9 million barrels from Russian export terminals, according to vessel-tracking data and port agent reports collated by Bloomberg. That put average seaborne crude flows at 3.56 million barrels a day, down by about 2% against a revised 3.62 million barrels a day in the week ended April 29.

Despite stable shipments, Moscow’s revenue from export duty tumbled ahead of Russia’s Victory Day celebrations, as President Vladimir Putin’s war in Ukraine grinds on. The EU is edging closer to sanctions on Russian oil, though it still needs to overcome opposition from Hungary. At current rates of crude oil export duty, the week’s shipments will have earned the Kremlin about $176 million; that’s $34 million less than the previous week and the lowest weekly figure in six weeks.

Russia exports crude from four main areas: the Baltic Sea in northwest Europe, the Black Sea, the Arctic, and terminals on its Pacific Coast.

The weekly shipment figures can swing depending on the timing of when tankers depart, which is also heavily influenced by the weather at ports -- as has been the case for the past several weeks.

Flows of Urals and Siberian Light crude from terminals in the Baltic and Black Sea in the week to May 6 fell by 460,000 barrels a day, or 17%, with lower flows from the Black Sea port of Novorossiysk and the Baltic ports of Primorsk and Ust-Luga.

Meanwhile, shipments from the country’s three eastern terminals on its Pacific Ocean coast reversed most of the previous week’s drop, rising by 310,000 barrels a day, or 43%.

Cargoes from Murmansk, which handles crude produced along Russia’s Arctic coastline were also up, increasing by 86,000 barrels a day, or 35%.

Hungary has continued to block a European Union proposal that would ban Russian oil imports, despite being offered a longer period to implement the switch. The EU’s proposal seeks to end crude oil purchases over the next six months and refined fuels by early January. The bloc offered Hungary and Slovakia until the end of 2024 to comply with the sanctions and the Czech Republic until June of the same year as they are heavily reliant on Russian crude, but that has not been enough to placate Hungary. Talks are continuing.

A proposal to ban European companies and individuals from providing vessels and services, such as insurance, needed to transport oil to third countries, has also run into trouble. Greece and Cyprus want the vessels portion of that proposal delayed until after G-7 countries adopt similar measures.

Self-sanctioning of Russian crude by European companies has diverted flows to Asia, while having little impact on the overall level of crude shipments. A bigger impact on Moscow’s earnings from crude exports has come from the drop in the level of export duty charged on each barrel shipped overseas that came into effect on May 1. Crude oil export duty is set at $49.60 a ton, equivalent to about $6.81 a barrel, in May. That’s down from $61.20 a ton, or $8.30 a barrel in April.

The number of cargoes shipped from Russian ports was unchanged in the week to May 6 compared with the previous seven days, with 34 tankers departing in both periods. Fewer ships departed from ports in the Baltic and Black Sea, while shipments rose from Murmansk in the Arctic and Kozmino in the Pacific.

Shipments of Sokol crude from the Pacific port of De Kastri appear to be grinding to a halt. The last two cargoes on the April program were missed and there has been only one loading in the first six days of May. The ship carrying that cargo is now anchored full off the Russian port of Kozmino, while three more Russian-owned shuttle tankers that regularly carry the grade are anchored empty off the loading terminal at De Kastri.

In the Black Sea, loadings from Novorossiysk were still running behind schedule by the end of the week. But a gap in the loading program, with just two cargoes scheduled to load in the first week of May, should allow the backlog to be cleared soon.

The following charts show the destinations of crude cargoes from each of the four export regions. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress.

The volume of crude on ships loading from the Baltic terminals at Primorsk and Ust-Luga fell to a three-week low in the first week of May. The volumes on tankers showing destinations in Asia and the Mediterranean tumbled, though many of the vessels that aren’t indicating credible final destinations are likely to end up in one or other of those regions.

All cargoes scheduled to load at Primorsk and Ust-Luga during the week to May 6 were shipped within a day of their planned loading dates.

Six tankers completed loading at Novorossiysk in the Black Sea in the week to May 6, that’s down one on the previous week. Shipments to Asia slipped, with two tankers heading out of the Black Sea/Mediterranean region.

Thee ships loaded from floating storage facilities at Murmansk. One discharged at Wilhelmshaven in Germnay, one is heading to Rotterdam and the other to Lukoil’s refinery in Sicily.

Crude shipments from Russia’s three eastern oil terminals during the week to May 6 edged higher, but issues are mounting in shipping crude from projects around Sakhalin Island.

Shipments from those projects are made in shuttle tankers belonging to Russian-owned tanker company Sovcomflot PJSC, but sanctions on the company appear to be having an impact. A first non-Russian tanker loaded a cargo of Sakhalin Blend at the start of May and a second is on its way to the terminal, while two Sovcomflot ships that would normally carry the grade are anchored empty near the terminal.

It is a similar picture at De Kastri, which handles Sokol crude from the Sakhalin 1 project. Three Sovcomflot tankers have been anchored off the oil terminal for as many as 22 days, with just one cargo loaded in the first week of May. The ship holding that cargo is now anchored full off the Russian port of Nakhodka.

Five ships headed to Asia from Russia’s western ports in the week to May 6. Another four left without signaling a clear final destination.

Of those five vessels showing destinations in Asia, four are heading to India, while the other is showing an interim destination of Suez.

There were no observed ship-to-ship transfers of Russian crude in the week to May 6. The Aframax tanker Vergios arrived off the Spanish North African town of Ceuta on May 3 carrying a cargo of Urals crude. It is still in the area, where it was joined by the empty Sovcomflot Suezmax tanker Adygeya on May 6. The area has become a popular site for such transfers.

A first cargo of Russian Urals crude has arrived at Fujairah and a second is due to get there on April 13. A shipment of ESPO crude from Kozmino is also heading to Fujairah, with an expected arrival date of May 25, according to the ship’s destination signal.

The Aframax tanker Nissos Delos has been anchored off the Sri Lankan port of Colombo since April 25, but does not appear to have discharged any of its crude.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: Bloomberg uses commercial ship-tracking data to monitor the movement of vessels. Ships can avoid detection by turning off on-board transponders, as has been done widely by the Iranian tanker fleet. There is no evidence yet that this is being done by crude oil tankers calling at Russian ports.

Note: Destinations are those signaled by the vessel and are monitored until the cargo is discharged. Destinations may change during a voyage, even under normal circumstances, and the final discharge point for the cargo may not be known until that port is reached.

Note: Cargo volumes are based on loading programs, where those are available, and on a combination of the ship’s capacity and its depth in the water where we have no other information.

©2022 Bloomberg L.P.