Nov 28, 2022

Russian Oil Keeps Gushing Despite Uncertainty Over Price Cap

, Bloomberg News

(Bloomberg) -- Overall crude shipments from Russian ports have yet to show clear evidence of drying up as a result of impending European Union sanctions, despite a massive diversion from Europe to Asia.

EU countries have been struggling to find a level at which they can agree to cap Russian crude prices, leaving buyers in limbo before the group’s sanctions come into effect on Dec. 5.

Should the politicians fail, which remains an outside possibility, EU companies will no longer be able to provide insurance and other services to ships carrying Russian crude and seaborne imports to the bloc will cease. If they succeed, European countries will still halt purchases from Russia, but companies will be permitted to carry Russian crude in European ships and to provide insurance and services as long as the cargo was purchased at a price below the cap.

Shipments could still fall sharply, with Moscow readying a law of its own to ban sales to countries that participate in the price cap. That could hit seaborne flows to Bulgaria and possibly pipeline deliveries to Hungary, Slovakia and the Czech Republic, all of which have received exemptions from the EU’s import ban.

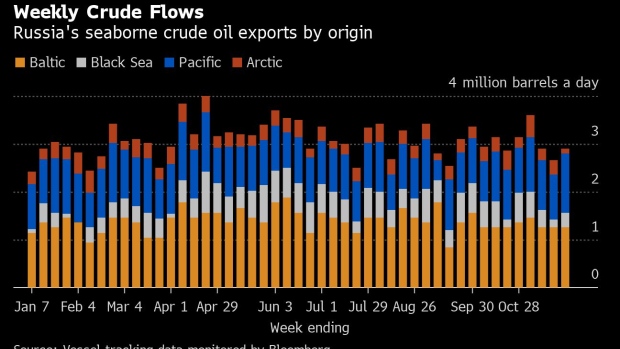

Total volumes shipped from Russia rebounded to 2.89 million barrels a day in the seven days to Nov. 25, while the less volatile four-week average continued to slide toward 3 million barrels a day. The Kremlin's four-weekly average revenue from crude oil export duty dropped to its lowest for the year so far.

The volume of crude on vessels heading to China, India and Turkey, the three countries that have emerged as the biggest buyers of displaced Russian supplies, plus the quantities on ships that are yet to show a final destination, rose again to a new high of 2.5 million barrels a day in the four weeks to Nov. 25. That’s three-and-a-half times as high as the volume shipped in the four weeks immediately prior to Russia’s invasion of Ukraine in late February.

Tankers hauling Russian crude are becoming more cagey about their final destinations. The volume of crude on vessels leaving the Baltic and showing their next destination as Port Said or the Suez Canal jumped to almost 650,000 barrels a day. It remains likely that most of these vessels will begin to signal Indian ports once they pass through the canal.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports edged lower for a third week to 3.01 million barrels a day. Flows remained above 3 million barrels a day for a seventh week. Shipments to Asia hit a new high, while those to Europe continued to move in the opposite direction.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from the EU sanctions.

-

Asia

Shipments to Russia’s Asian customers, plus those on vessels showing no final destination, which typically end up in either India or China, rose for a fifth week. While the volume on vessels signaling Indian ports as their destination slumped, the number of ships showing destinations as either Port Said or Suez soared. Those voyages typically end at ports in India and show up in the chart below as “Unknown Asia,” as do the volumes expected to be transferred from one ship to another off the South Korean port of Yeosu.

The “Unknown” volumes are those on tankers showing a destination of Gibraltar. Most of those cargoes go on to transit the Suez Canal, but some could end up in the Mediterranean region.

The total volume of crude expected to end up in Asia hit 2.3 million barrels a day on a four-week rolling average basis, including 115,000 barrels a day on tankers whose point of discharge is unclear. The combined figure set a new high for the year so far.

-

Europe

Russia’s seaborne crude exports to European countries fell below 500,000 barrels a day in the 28 days to Nov. 25, taking them to less than one-third of the levels seen before Moscow’s troops invaded Ukraine. Flows were down by 104,000 barrels a day, or 18%, from the period to Nov. 18. These figures do not include shipments to Turkey.

The volume shipped from Russia to northern European countries remained at the previous week’s low, with Rotterdam still the only destination for deliveries to the region. Flows were 95,000 barrels a day in the four weeks to Nov. 25, down from more than 1.2 million barrels a day before Moscow's troops invaded Ukraine in late February.

Exports to Mediterranean countries slipped to 459,000 barrels a day on average in the four weeks to Nov. 25, down from 631,000 barrels a day in the same period to Nov. 18. Flows to the region, including Turkey, which is excluded from the European figures at the top of this section, fell for a third week.

Shipments to Italy dropped to their lowest since April. The country’s largest refinery, the ISAB plant in Sicily owned by Lukoil PJSC, is struggling to secure credit to buy crude. Since Russia’s invasion of Ukraine it has been processing Lukoil’s own crude, much of it shipped from the Arctic, but that flow will have to stop in a week’s time, when EU sanctions on seaborne imports of Russian crude come into effect.

Flows to Turkey also fell, dropping to their lowest since July on a four-week average basis. However, they remain more than twice the volume typically seen before the invasion, and the country is expected to continue to be an important destination for Russian crude after Dec. 5.

Combined flows to Bulgaria and Romania fell to 125,000 barrels a day, with no tankers heading to Romania for the first time this year. Bulgaria secured a partial exemption from the EU ban on seaborne crude imports from Russia, which should support inflows after the embargo comes into force. However, it remains unclear whether a proposed Russian ban on sales to countries that participate in the US-led price cap mechanism will affect shipments to the country.

Flows by Export Location

Aggregate flows of Russian crude rose by 226,000 barrels a day, or 8%, in the seven days to Nov. 25, recovering all of the previous week’s loss. Shipments from the Black Sea and the Pacific both rose, while exports slumped from the Arctic port of Murmansk. The flows of Russian crude from the Baltic ports of Primorsk and Ust-Luga were unchanged from the previous week. Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rose by $9 million to $118 million in the seven days to Nov. 25, while the four-week average income continued to drop, falling by $4 million to $123 million. The four-week average was the lowest so far this year.

The November duty rate is $5.83 a barrel, the lowest level since January 2021, with the Urals discount to Brent during the latest calculation period, which ran from Sept. 15 to Oct. 14, at about $25.50 a barrel. The December duty rate will be 8 cents a barrel higher at $5.91, according to figures released by the Russian Ministry of Finance.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 28 tankers loaded 20.24 million barrels of Russian crude in the week to Nov. 25, vessel-tracking data and port agent reports show. That’s up by 1.6 million barrels, or 8%, from the previous week. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals was unchanged in the week to Nov. 25, with no shipments to northern Europe. All of the crude loaded at Baltic ports is now headed to Asia or the Mediterranean, with the two vessels showing no final destination both signaling Gibraltar as the next point on their voyages.

Shipments from Novorossiysk in the Black Sea rebounded from the previous week’s low, but remained less than half the levels seen in June.

Arctic shipments slumped with just one tanker departing Murmansk in the week to Nov. 25.

Shipments from the Pacific jumped to equal their highest level for the year so far. All of the cargoes heading for unknown destinations are on ships going to Yeosu in South Korea, where it’s likely that they will conduct ship-to-ship transfers outside the port, as previous tankers have done. All cargoes of Sokol crude loaded since shipments restarted last month have been moved in this way, with most eventually heading to India.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDE }. The numbers, which are generated by a bot, may differ from those in this story.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }.

--With assistance from Sherry Su.

©2022 Bloomberg L.P.