May 20, 2022

S&P 500 sinks into bear market amid brutal equities selloff

, Bloomberg News

Markets have yet to price in the withdrawal of economic liquidity: Macro strategist

A two-year run in stocks that began at the depths of the coronavirus panic and became one of most powerful bull markets on record is on the brink of extinction.

The S&P 500 slipped more than two per cent on Friday, pushing it 20 per cent below its record closing high of 4,796.56 on Jan. 3. If the losses hold through the close of trading, it will enter its first bear market since the pandemic hit in February 2020.

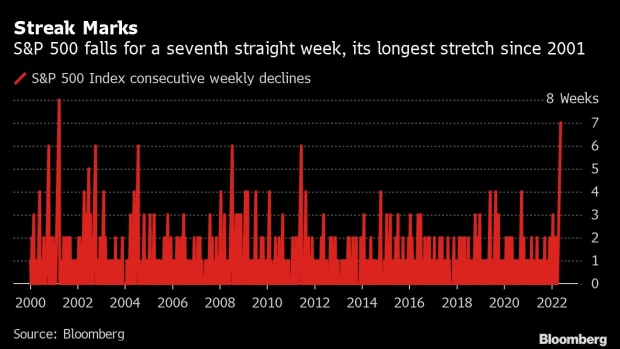

The broad equities benchmark is on pace for a seven-week slide, its longest weekly lossing streak since March 2001, while the Dow Jones Industrial Average is heading for its eighth straight week of declines, the longest since 1923. The tech-heavy Nasdaq 100 Index is also down for a seventh week, its longest stretch since 2011.

At both ends of the moves sits the Federal Reserve, whose unprecedented efforts to boost the economy in early 2020 helped the S&P 500 more than double through the end of last year. Now, with central bankers reining in stimulus as inflation surges, shares are selling off at the hands of investors convinced a recession is all but unavoidable.

“All of this has been driven by two major forces that were reiterated this week: one is inflation and how stubbornly high it is. And the second is how aggressive the Federal Reserve will likely be to get it under control,” said Art Hogan, chief market strategist at National Securities.

Tech stocks are dragging the market lower, with the Nasdaq 100 Index sliding as much as three per cent on Friday. Apple Inc. and Amazon.com are poised for an eighth straight weekly drop, while Tesla Inc. falls for a fourth one. The group has come under widespread pressure this year. According to S3 Partners, tech is the most shorted sector in the US market, “making up almost US$1 out of every US$5 shorted.” Software is the most shorted industry within the sector.

Consumer discretionary sector has been the worst performing group in the S&P 500, plunging 35 per cent since the index’s January high. The only S&P 500 sector to gain this year is energy, which is up 41 per cent since the index hit its peak.

RETAILERS PLUNGE

Friday’s selloff caps a volatile week for the US stock markets, which saw consumer stalwarts that thrived throughout the pandemic-era bull market buckle.

Target Corp. plunged the most since Black Monday in 1987, a day after Walmart Inc. suffered a similar fate, on signs that runaway inflation is hurting the US consumer and eroding profit margins.

“The Fed has been a primary driver of these market declines, but the latest news from retailers has added additional concerns to the outlook for the economy,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “Now that we’ve breached the 20% level, the big question will be where do we go from here?.”

Since 1929, the S&P 500 has entered a bear market 17 times, including Friday, according to data from CFRA Research. The longest period lasted 998 days from September 1929 to June 1932. The shortest was just 33 days from Feb. 19, 2020, to March 23, 2020, CFRA’s data show.

On average, bear markets result in a decline of roughly 38 per cent, although since 1946 the average loss is less than 33 per cent, according to CFRA.

“It was bound to happen because I think the bears wanted to push it there. And a fair amount of people had turned bearish,” said Mike Mullaney, director of global markets research at Boston Partners. “Positioning is catching up with sentiment right now.”