Apr 1, 2019

Saudi Oil Giant Aramco Starts Bond Roadshow, Gets A+ Rating

, Bloomberg News

(Bloomberg) -- Saudi Aramco, the world’s largest oil producer, has been rated A+ by Fitch Ratings, the first public assessment of the company’s credit quality as it prepares for its debut international bond offering.

Fitch also gave an expected A+ rating, the fifth-highest investment grade level, to an upcoming bond offering from the company. The oil giant has mandated banks to hold a roadshow for dollar-denominated notes from April 1, according to a person familiar with the matter. The state-owned company has the same rating as the sovereign from Fitch.

The oil giant picked banks including JPMorgan Chase & Co. and Morgan Stanley to manage the debt offering, the person familiar said Monday. Proceeds from the sale, which Saudi Energy Minister Khalid Al-Falih said in January could raise about $10 billion, will be used to help fund its purchase of a 70 percent stake in Saudi Basic Industries Corp.

Saudi Aramco Profit Dwarfed the Biggest Global Companies in 2018

The offering will force Aramco to disclose its accounts to investors for the first time since its nationalization about four decades ago. It’s also a precursor to even greater transparency required for its initial public offering, planned for 2021.

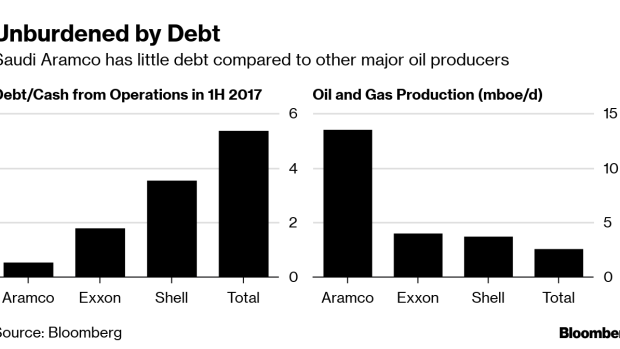

Aramco’s credit assessment is constrained by that of the sovereign, Fitch said. Its standalone profile corresponds to a rating of AA+ and reflects the company’s high production, vast reserves, low production costs and very conservative financial profile. Fitch said the Saudi company is less integrated into natural gas and downstream than some of its international peers.

Fitch’s A+ rating for Aramco is one level below the AA- for both Royal Dutch Shell Plc and Total SA. Exxon Mobil Corp. has a top Aaa rating from Moody’s Investors Service and a second-highest AA+ from S&P Global Ratings.

The Saudi oil producer follows state-owned Abu Dhabi National Oil Co., which got a AA long-term credit rating at Fitch in February. Adnoc’s standalone rating was AA+, Fitch said.

(Adds Aramco’s standalone rating in fifth paragraph, other oil company ratings in sixth paragraph.)

To contact the reporter on this story: Matthew Martin in Dubai at mmartin128@bloomberg.net

To contact the editors responsible for this story: Stefania Bianchi at sbianchi10@bloomberg.net, Shaji Mathew, Beth Thomas

©2019 Bloomberg L.P.