Oct 21, 2022

Shorting Colombia’s Peso Is a Top Trade at Brazilian Hedge Funds

, Bloomberg News

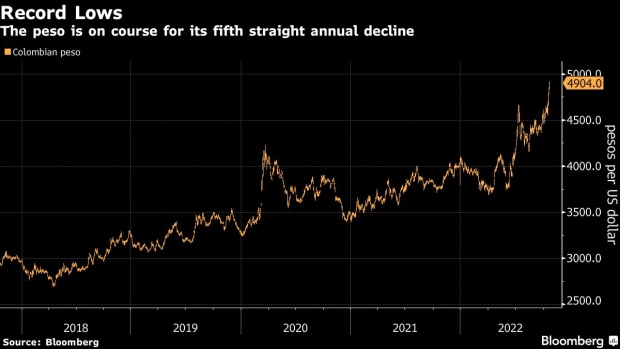

(Bloomberg) -- No currency has been harder hit than the Colombian peso over the past month, and Brazilian hedge funds are partly to blame.

Trading desks in Rio de Janeiro and Sao Paulo are piling into short bets on the peso, wagers that not only pay off when the currency weakens but can also exert downward pressure. They see storm clouds gathering over their Andean neighbor, and predict the nation’s fiscal and current account deficits will leave it extra vulnerable to a global economic slowdown.

“Colombia has weak fundamentals,” said Guilherme Lemos, the portfolio manager responsible for the Latin America book at XP Asset Management, which went short the peso against the dollar about two months ago. “The currency should continue to weaken in the coming months.”

The peso has dropped 10% in just the past month, the worst performance among major currencies, and Lemos has added to his bets on a decline. He’s keyed in on recent “dovish signs” from central bank policymakers even as inflation surprises to the upside.

Kapitalo Investimentos Ltda., which has over 26 billion reais ($5 billion) under management, told clients earlier this month that its flagship fund increased its short peso position. JGP Asset Management said long positions in the US dollar against a basket of currencies including the peso helped juice returns in September.

Local funds are also embarking on relative trades such as going long the Brazilian real against regional peers like the peso.

“That way you’re ‘risk neutral’ and get to balance the portfolio with interesting idiosyncratic stories,” said Sergio Zanini, partner and chief investment officer at asset manager Galapagos Capital in Sao Paulo.

Investors have punished Colombia since the election of the leftist President Gustavo Petro, who has vowed to end new oil exploration and floated ideas like issuing debt to buy land for the poor. Benchmark bond yields are at the highest in nearly two decades, and local notes have lost almost 24% in dollar terms since Petro was elected in June, four times the average for emerging markets during that period. The peso has weakened 21% since then.

--With assistance from Andrea Jaramillo.

(Updates peso moves beginning in fourth paragraph)

©2022 Bloomberg L.P.