Dec 14, 2023

SNB Calls End to Hiking Cycle, Signals Shift in Currency Policy

, Bloomberg News

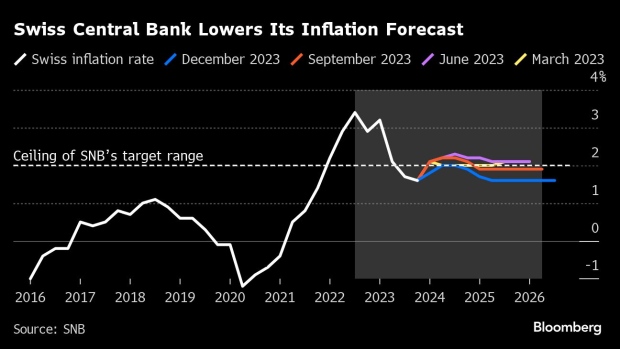

(Bloomberg) -- The Swiss National Bank called an end to its tightening cycle and signaled a shift in its currency policy as it kept borrowing costs unchanged after inflation slowed emphatically below its ceiling.

“Monetary conditions are adequate and we do not have to hint at any change of monetary policy in the future,” President Thomas Jordan told Bloomberg TV. “Price stability is already ensured given our newest inflation forecast.”

Policymakers left their key interest rate at 1.75% for a second consecutive meeting on Thursday. While the SNB is still willing to intervene in currency markets, Jordan said that can go in both directions and the central bank is no longer focusing on sales.

Even though the SNB doesn’t forecast inflation to rise above its 2% ceiling before at least 2026, Jordan made it clear that for the time being hikes are off the table. Instead, lowering borrowing costs could be in the cards at future meetings.

“In three months, we will look very carefully at the new forecast,” he told Bloomberg TV. “Depending on the situation then, we will adapt monetary policy.”

Still, market expectations suggest that a rate cut will likely come already in March. Capital Economics’s Adrian Prettejohn says in a client note that overall the SNB will reduce borrowing costs by 75 basis points next year.

Weakest Growth

With Switzerland facing the weakest growth in four years for 2024, inflation down to 1.4%, and the franc close to at an eight-year high against the euro, the central bank is in a holding pattern.

Jordan said that officials will have to change tack if the franc’s exchange rate made monetary conditions too restrictive. He cautioned that all forecasts are surrounded by high uncertainty at the moment.

The franc whipsawed following the decision against the dollar and poked up to its strongest in nearly five months. Against the euro, it slipped to its lowest in almost two weeks.

SNB officials’ caution to embrace the prospect of rate cuts comes amid investor bets that the Federal Reserve and other global peers will do so soon. US officials released forecasts amounting to a pivot toward eventual easing.

European counterparts are under pressure to follow suit later on Thursday. Both the Bank of England and European Central Bank are anticipated to keep borrowing costs unchanged in their last decisions of 2023. Meanwhile, Norwegian officials delivered what is probably a final rate hike.

Still, the SNB is likely to “start selling Swiss francs before considering rate cuts,” ING analysts Charlotte de Montpellier and Chris Turner wrote in a note. “There is nothing to suggest that rate cuts will be forthcoming soon.”

According to their forecasts, the outlook will remain similarly benign. They envisage inflation of 2.1% for this year, 1.9% next and 1.6% in 2025.

SNB’s tighter policy has started to weigh on growth, as the third quarter saw slim expansion after the second was revised to contraction. The central bank expects the Swiss economy to grow around 1% this year and in a range of 0.5% to 1% in 2024.

--With assistance from Laura Malsch, Jana Randow, William Horobin, James Regan, Harumi Ichikura, Kristian Siedenburg, Joel Rinneby and Alexey Anishchuk.

(Updates with Jordan quotes in Bloomberg TV interview from second paragraph)

©2023 Bloomberg L.P.