Apr 14, 2023

Soaring Chip Stock Valuations Are Defying Industry Gloom

, Bloomberg News

(Bloomberg) -- Chip stocks are rallying like it’s 2021. Only it isn’t. And now some investors are getting cold feet.

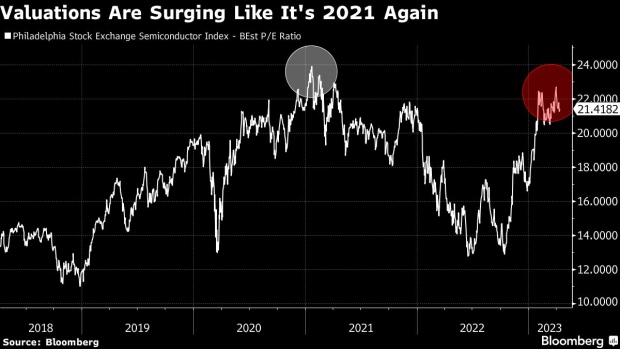

After surging 28% in the first quarter, the Philadelphia semiconductor index is trading at a price-to-projected earnings ratio that’s approaching peak levels of two years ago, back when demand was so high for everything from personal computers to refrigerators that chipmakers couldn’t keep up. The trouble is, companies like Micron Technology Inc. now have the opposite problem — too much supply.

“Sentiment is probably as strong as it gets, or close to it,” said Timothy Ghriskey, senior portfolio strategist at Ingalls & Snyder. “It wouldn’t surprise me if the next move was down as supply and demand trends come into focus.”

The Philadelphia Stock Exchange Semiconductor Index dipped 0.1% on Friday.

Just as last year markets anticipated tougher times for the industry, driving share prices steeply lower, they’re now betting on a recovery as signs emerge that firms are working through excess inventory and seeing improved demand. Micron, Western Digital Corp. and other makers of memory chips rallied in the past week after Samsung Electronics Co. said it’s cutting production in an effort to restore equilibrium to the market. But it’s unclear how quickly the recovery will deliver the growth to justify the steep run-up in many stocks.

Matt Bryson, an analyst at Wedbush Securities Inc., said he’s struggling to explain why the stocks have rallied so much. “The semiconductor recovery is getting shallower and later,” he said.

Semiconductors have always been a leading indicator of demand for electronics. It takes years to build and a equip a plant and months to manufacture one of the tiny electronic components. Makers of electronic devices are well accustomed to lead times – the interval between ordering and taking delivery – of as long as a year from their chip suppliers.

Those long-lead times have helped make the chip industry notorious for boom-to-bust cycles as once-hungry customers can quickly slash orders when demand fizzles. Investors have historically looked to get in at the low point of the cycles, anticipating steep upswings that typically follow.

High Valuations

This time is no exception. Having traded at about 13 times projected profits as recently as October, the index of 30 chip-related companies is now priced at about 21 times, not far off a peak around 24 times in 2021, according to data compiled by Bloomberg. Nvidia trades at an eye-watering 56 times after a benchmark-leading gain of more than 80% this year fueled by speculation its sales will be supercharged by investments in gear to power artificial intelligence applications.

Yet industry data is hardly encouraging. According to the World Semiconductor Trade Statistics Organization, total chip sales fell 4% in February compared with the month before. That marked the sixth-consecutive year-over-year decline.

Within that there are confusing signs for investors looking to gauge whether the semiconductor market has bottomed. There’s continuing weakness in the memory market, and in smartphones, personal computer and graphics chips, according to Cowen & Co. analyst Matt Ramsay. Pricing for some components used in the automotive and industrial markets remains strong, he wrote in a note, showing “end market demand continues to diverge amid an uncertain macro environment.”

With the first-quarter earnings season about to start, the outlook for semiconductor profits continues to deteriorate. Earnings for chip-related firms in the S&P 500 are projected to drop about 25% in 2023, down from expectations for a 16% contraction at the beginning of the year, according to data compiled by Bloomberg Intelligence.

The combination of rising stock prices and falling profits could make for a difficult reporting season for chipmakers, said Jefferies analyst Mark Lipacis, even though he’s bullish on their long-term prospects.

“The set-up into earnings season is more challenging than it has been for the past six quarters given significant outperformance over the past five months,” he wrote.

Tech Chart of the Day

Apple Inc. has the biggest pile of cash and marketable securities of any Nasdaq 100 component, ending its fiscal first quarter with about $165 billion. Yet while that’s an enormous sum, it’s also the smallest amount since 2014. The tech giant is spending billions in share buybacks as it returns money to shareholders.

Top Tech Stories

- Infosys Ltd. forecast sales that lagged estimates and warned customers in key sectors like finance are pulling back, a sign of how far corporations are tightening their budgets to weather an economic slowdown.

- Dozens of advocacy organizations and children’s safety experts are calling on Meta Platforms Inc. to terminate its plans to allow minors into its new virtual reality world.

- Amazon.com Inc. Chief Executive Officer Andy Jassy pledged to keep investing in big long-term bets despite cost-cuts and an uncertain economy, moving ahead with a global expansion and efforts to become a bigger player in groceries and healthcare.

- SoftBank Group Corp. is moving to sell more of its stake in Chinese internet giant Alibaba Group Holding Ltd., unwinding the bet that spurred the Japanese company’s ambition to invest billions of dollars into startups.

- Taiwan’s success in the semiconductor industry is fueling a boom in house prices that is spreading from north to south, with highly paid workers at major chipmakers pushing the property market to buck the trend of a global slowdown.

--With assistance from Subrat Patnaik, Tom Contiliano and Rheaa Rao.

(Updates to market open.)

©2023 Bloomberg L.P.