Apr 19, 2024

Softbank-Backed Oyo Eyes $450 Million Bond Sale for Refinancing

, Bloomberg News

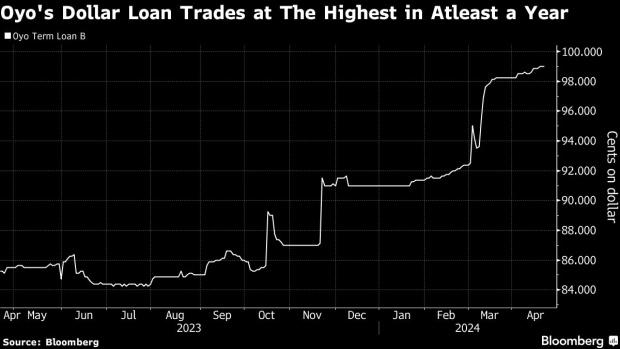

(Bloomberg) -- Oyo Hotels is in talks to raise up to $450 million via dollar bonds, a person familiar with the matter said, as the once-high-flying Indian startup seeks to replace an existing high-cost loan amid delays in its stock-market debut.

Oravel Stays Ltd., as Oyo’s parent company is known, is in discussions with bankers for raising $350 million to $450 million to repay its term loan B, which is due in 2026, the person said, asking not to be named as the information is private.

The refinancing will extend the repayment timeline to five years, the person said. The company plans to complete the process in the September quarter.

In 2021, the company borrowed $660 million, with about $465 million still outstanding after the hotel-booking firm backed by Softbank Group Corp. prepaid a portion of it last year. A representative from Oyo declined to comment on the planned transaction.

Oyo is seeking to reduce interest payments and shift its focus to profitability after setbacks in its initial public offering plan. The company posted its first-ever profit in the September quarter, and Fitch Ratings said it will consider a positive rating action as leverage comes down.

Founder Ritesh Agarwal has long sought to execute an initial share sale for the startup and even held talks with the Malaysian sovereign wealth fund Khazanah Nasional Bhd. for an equity funding earlier this year. Despite the recovery in the travel market from the Covid-era trough, Oyo — once valued around $10 billion as India’s answer to Airbnb — has yet to decide on a timing for its IPO.

The refinancing would require Oyo to refile its draft red herring prospectus for the share sale due to its material impact on existing disclosures to India’s securities regulator, the person said.

©2024 Bloomberg L.P.