Mar 1, 2024

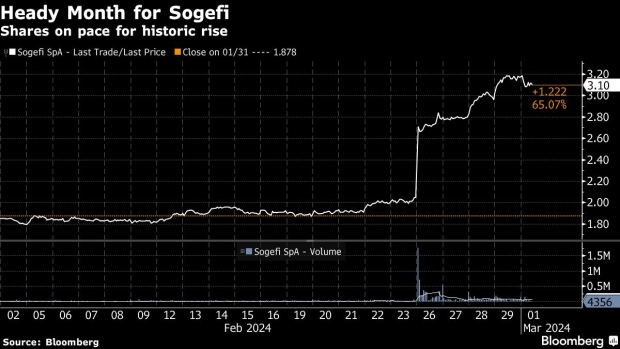

Sogefi Shares on Pace for Best Week Ever on Deal to Sell a Unit

, Bloomberg News

(Bloomberg) -- Shares of Sogefi SpA have gained over 50% so far this week in Milan — on pace for their best performance ever — after the car-parts maker agreed to sell a division to US-based Pacific Avenue Capital Partners LLC at a price that almost matches the Italian firm’s market value.

Sogefi said Feb. 23 that it entered into a put-option agreement with Pacific Avenue for the sale of its filtration business at an enterprise value of €374 million ($405 million).

That figure is about the same as the Italian firm’s entire market cap — even after the share price rise.

The shares dipped 2% as of 12:47 p.m. local time on Friday, but were still on pace to finish up 52% for the week.

The transaction means Sogefi will be less exposed to risks related to the transition to e-mobility, the company said, while allowing for “the reduction of the complexity and diversification of the group.”

Sogefi designs, develops and produces components for major auto manufacturers including Ford Motor Co. and Renault SA.

Listed on the Milan exchange since 1986, Sogefi is controlled by the De Benedetti family’s CIR SpA holding.

Banca Akros analysts said Feb. 26 that the news on the sale was “of paramount importance, also given the good valuation implied in the deal.” Akros raised its target on the stock to €4.3 while maintaining its buy rating.

Analysts at Equita Sim said the move revives “speculative appeal concerning the sale of the remaining two divisions.”

©2024 Bloomberg L.P.