Oct 17, 2022

Some ECB Officials See Legal Basis to Toughen Banks’ TLTRO Terms

, Bloomberg News

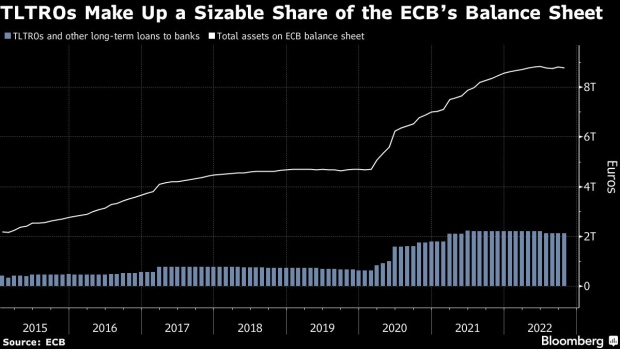

(Bloomberg) -- Some European Central Bank policymakers reckon it’s legally feasible to revise long-term lending conditions for banks after the terms became more generous because of changes in the economy, according to officials familiar with the matter.

The so-called TLTRO loans were first issued in 2014 to encourage banks to lend as Europe’s debt crisis weighed on growth and threatened to trigger a bout of deflation. They served a similar purpose after the pandemic struck.

Since then, however, record consumer-price gains of 10% and interest rates rising rapidly after years below zero have undermined the case for those contracts, said the officials, who asked not to be identified as the debate is private.

While changing an agreement could run into legal opposition, such concerns are surmountable, the officials said. Other options being discussed are remunerating TLTRO funds held at the ECB at a lower rate, or paying staggered interest rates, according to one of them.

That would trim or eliminate the return banks can currently earn by parking funds borrowed through the TLTRO program in the ECB’s deposit facility, where rates are currently 0.75% and may be double that by the end of the month.

ECB President Christine Lagarde said in September that a TLTRO review will be “conducted in due course,” with the Oct. 26-27 meeting the next chance to address the issue. An ECB spokesperson declined to comment.

What Bloomberg Economics Says:

“The Governing Council will probably want to tread carefully. It still has to worry about too many simultaneous changes unsettling markets.”

--David Powell, senior euro-zone economist. Click here for full Insight

Officials understand that continuing to allow banks to make a risk-free return on TLTRO cash is problematic as taxpayers struggle amid soaring energy costs. But their main concern is that the credit growth the cheap loans are designed to fuel risks further stoking inflation, which is five times their target.

“In the context of the pandemic, the TLTRO III provided a lot of liquidity to banks, just over €2 trillion euros ($1.9 trillion) at a very attractive rate for banks, a negative interest rate,” ECB Vice President Luis de Guindos said Monday in Madrid. “But the TLTRO was born in an environment of the pandemic. And the pandemic at this time is no longer the threat it was compared to what we had in March 2020, and we are also in the process of normalizing monetary policy.”

Banks are currently charged interest equivalent to the average ECB deposit rate over the life of the TLTRO loan, the last of which won’t mature until the end of 2024. Despite borrowing costs now being lifted, that average is held back by eight years in subzero territory.

(Updates with Bloomberg Economics in seventh paragraph. An earlier version was corrected to removes an erroneous reference to minimum reserve requirements.)

©2022 Bloomberg L.P.