Nov 11, 2022

Son Bids Goodbye to Investor Calls as SoftBank Turns Defensive

, Bloomberg News

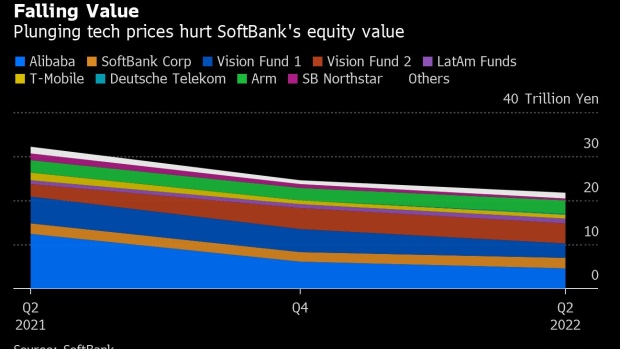

(Bloomberg) -- SoftBank Group Corp. founder Masayoshi Son bade farewell to the earnings presentations he’s led for decades, as plunging startup valuations force the company into all-out defense.

The 65-year-old said he would no longer speak at the quarterly events after the Tokyo-based company’s Vision Fund investment arm posted a $7.2 billion loss. He’s turning responsibility for the events over to Chief Financial Officer Yoshimitsu Goto, along with several lieutenants.

SoftBank, which for years was the world’s most aggressive tech investor, has virtually halted new investments and focused on its balance sheet. With no clear recovery in sight, Son said he is no longer the right person to lead the calls and that he would focus his time on taking its chip designer Arm Ltd. public. Son declared Goto, a low-profile former banker, the company’s defensive champion.

“Goto is more suitable than me for playing defense,” Son said during what he said would be his last earnings results briefing “Me, I’m an aggressive person, not a defensive person, and I’d like to concentrate on Arm for the time being.”

Son had used the quarterly events to talk up his eclectic investment philosophies, waxing poetic about how technology could improve mankind’s happiness. He peppered presentations with flying unicorns and rainbows. His passion won him the loyalty of investors who held onto SoftBank’s stock through some of tech’s biggest downturns.

Inside the Baffling World of Masayoshi Son’s Presentations

Even on Friday, Son reprised several of his favorite themes. He recalled his earliest days as an entrepreneur in California when he first saw a photo of a microprocessor, claiming it brought him to tears.

“I couldn’t stop crying,” he said.

For his part, Goto said Son would remain firmly in charge of the company, but he said SoftBank had put too much on the shoulders of the founder.

“We at SoftBank have been spoiled by Son,” Goto said. “We need to break the habit of relying on him.”

Overall for the quarter, the Japanese conglomerate logged net income of 3.03 trillion yen in the last quarter, buoyed by the disposal of a chunk of its Alibaba Group Holding Ltd. stake. The company said its total profit on its disposal of Alibaba shares was 5.37 trillion yen.

Son turned his telecom company into the world’s biggest startup investor, intent on repeating his early success in backing the Chinese e-commerce pioneer. But the effort has been plagued by missteps and, more recently, a sharp downturn in technology valuations.

SoftBank has been struggling with declines on public investments, with the Vision Fund recording net valuation losses totaling 1.19 trillion on its public holdings in the quarter just ended. Of those, China’s SenseTime Group Inc. accounted for 364 billion yen, while US food delivery firm Doordash Inc. accounted for 225 billion yen and Indonesian ride-hailing and e-commerce firm GoTo Group 108 billion yen, it said.

“We need to go full-on defense,” Goto said. “SoftBank is pessimistic on the outlook. We do not yet see the light.”

As attention turns to SoftBank’s balance sheet, SoftBank has been hurrying to offload assets to bolster its bottom line and fund a share repurchase spree that has vaulted its share price more than 40% since the start of this quarter. SoftBank’s total interest-bearing debt, excluding telecom arm SoftBank Corp., stood at 13.7 trillion yen, down from more than 17 trillion yen at the end of June.

Other investment losses loom on the horizon. Goto said that SoftBank’s stake in the troubled crypto exchange FTX.com amounted to a little less than $100 million. So even if SoftBank wrote off the entire amount, it would not be a material loss. Crypto occupies only 1.3% of the Vision Fund’s portfolio -- even including indirect stakes -- as it doesn’t fit its investment philosophy, he said.

“I don’t think anyone can conclusively say that markets have bottomed,” said Kirk Boodry, an analyst at Redex Research, who publishes on Smartkarma.

Son and SoftBank have been trying to wait out the slump, selling off shares in Alibaba and Uber Technologies Inc. to raise cash and shore up its balance sheet. Much of its future investment strategy hinges its ability to make good on its $32 billion purchase of Arm and take it public next year.

Chipmaker sentiment has soured drastically in recent weeks, putting the onus on Arm’s finances to make any initial public offering successful.

Arm’s income slid to 5.8 billion yen in the September quarter, down 77% from a year earlier, according to financial details released with SoftBank’s results. Revenue rose slightly in yen terms, but declined about 17% in dollars.

The accelerated pace of its stock buybacks has sparked renewed speculation that Son may lead a management buyout of SoftBank -- something that Son has talked internally about, Bloomberg News has reported. Goto declined to comment on the possibility of the company going private.

Beyond Alibaba, SoftBank’s pipeline of asset sales that may fund future buybacks include UK online shopping group THG Plc, UK network provider Pelion Iot Ltd., distressed-debt specialist Fortress Investment Group and Indonesian ride-hailing and e-commerce firm GoTo Group, said Bloomberg Intelligence’s Marvin Lo.

Son said he would still take the lead at yearly shareholder meetings -- and he would come back if there’s a compelling reason to do so.

“I’ll continue to do the shareholder meetings, and when something unpredictable happens, I’ll come back anytime,” he said.

--With assistance from Vlad Savov and Jeanny Yu.

©2022 Bloomberg L.P.