Oct 5, 2022

Spanish Central Bank Halves 2023 GDP Forecast as Inflation Bites

, Bloomberg News

(Bloomberg) -- The Bank of Spain slashed the country’s growth forecast for next year in half as naggingly high inflation hits consumption and investment in the euro zone’s fourth-largest economy.

The central bank now expects a 1.4% expansion in gross domestic product in 2023, down from the 2.8% it predicted in June and well below the government’s estimate, which was cut to 2.1% this week. The institution expects the economy probably won’t return to pre-pandemic levels until the first three months of 2024, some two quarters later than it previously thought.

The downgrade “is due among other factors to the higher projected inflation rates, less favorable financing conditions, the increase in uncertainty and weaker global demand,” the central bank said in its quarterly report on Wednesday.

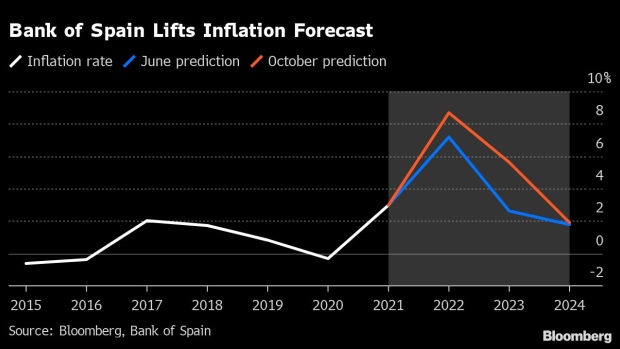

The Bank of Spain more than doubled its inflation forecast for next year to 5.6%. It expects consumer-price growth to slow to 1.9% in 2024, slightly above its June forecast of 1.8%.

Record inflation in the euro zone pushed the European Central Bank to raise interest rates by 125 basis points in two steps in July and September to prevent price rises from spiraling out of control and becoming entrenched.

Spain’s central bank governor, Pablo Hernandez de Cos, who is also a member of the ECB Governing Council, has said more hikes are needed. He has estimated that a terminal rate of 2.25% to 2.5% would bring inflation down to the ECB’s 2% target by the end of 2024.

While inflation eased more than expected in September to 9.3%, the Bank of Spain warned that price increases are spreading to about half of all products.

Spanish Prime Minister Pedro Sanchez has pledged more than 30 billion euros ($29.8 billion) in measures including fuel subsidies and tax cuts to ease the pain of soaring prices, partly funded by higher taxes on the rich, banks and energy companies.

©2022 Bloomberg L.P.