Feb 1, 2024

Stablecoin Tether’s Market Dominance May Jeopardize Crypto, JPMorgan Says

, Bloomberg News

(Bloomberg) -- Tether Holdings Ltd., the operator of the largest stablecoin, is expanding its commanding market share on the heels of record-breaking profits. That’s a risk for crypto overall, according to JPMorgan Chase & Co.

Tether’s USDT token is on the verge of surpassing $100 billion in circulation for the first time. Stablecoins, a form of crypto token pegged to another asset, use large reserves to support their value. They are integral to the way crypto markets operate, acting as a less volatile alternative for traders looking to swap between digital assets and to store their wealth.

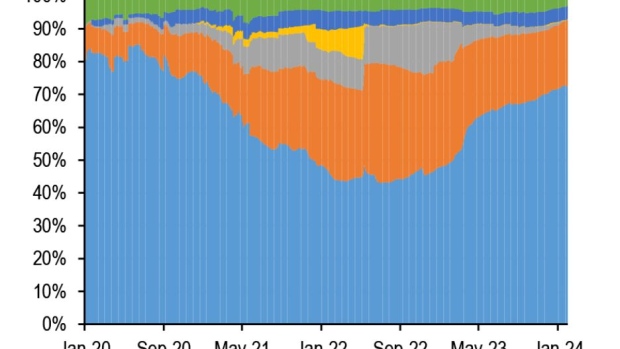

Growing concentration in USDT over the last two years has solidified its role as the leading stablecoin, but a “lack of regulatory compliance and transparency” by Tether is an increasing risk for the market, according to a report from JPMorgan released Thursday.

“Tether’s market domination may be a ‘negative’ for competitors including those in the banking industry wishing for similar success but it’s never been a negative for the markets that need us the most,” Paolo Ardoino, chief executive of Tether, said in a statement. “We’ve always worked closely with global regulators to educate them on the technology and provide guidance on how they must think about it.”

Stablecoins may soon be subject to increased regulation in the US and Europe. While the Clarity for Payment Stablecoin Act awaits a vote in the US House of Representatives, a partial implementation of the European Union’s Markets in Crypto-Assets Regulation (MiCA) is expected in June this year.

“Stablecoins issuers that have been more aligned with existing regulations are likely to benefit from the coming regulatory crackdown on stablecoins and gain market share,” JPMorgan analysts wrote.

Tether has worked to make its operations and finances more transparent through quarterly attestations since the company paid a $41 million fine to the CFTC in 2021 for lying about its reserves. Still, the market-leading stablecoin lags behind competitor Circle when it comes to regulatory adherence for its USDC token, the report said.

Tether is most traded cryptocurrency, and trails only Bitcoin and Ethereum in market capitalization. USDC is the seventh-largest digital token, with a market cap of about $27 billion, according to data compiled by CoinMarketCap.

--With assistance from Emily Nicolle.

©2024 Bloomberg L.P.