Oct 18, 2022

Stocks Volatility Prompts JPMorgan, Morgan Stanley to Shift Tone

, Bloomberg News

(Bloomberg) -- With their wild swings and reversals exacerbated by a Federal Reserve bent on curbing inflation, US equities have been anything but simple to call this year, a challenge exemplified just this week by two of Wall Street’s most prominent strategists.

Morgan Stanley’s Mike Wilson says US stocks are ripe for a short-term rally given the absence of an earnings capitulation. It’s an unusual positive call from a long-time bear who correctly foresaw this year’s slump.

In contrast, JPMorgan Chase & Co.’s Marko Kolanovic, among Wall Street’s most vocal bulls, has exhibited more caution for the coming months, citing increasing risks from central bank policies and geopolitics. Kolanovic, in effect, cut the size of his equity overweight and bond underweight allocations.

The shifting -- and diverging -- views between Wall Street firms highlight the uncertainty facing equities for the remainder of the year. In the latest Bloomberg survey of strategists, the highest year-end target shows a rise of nearly 39% for the S&P 500 from Monday’s close, while the lowest prediction suggests a nearly 13% drop.

Despite their modified short-term outlooks, Wilson still retains his overall negative long-term stance on equities, while Kolanovic sees stocks strongly higher by some point next year.

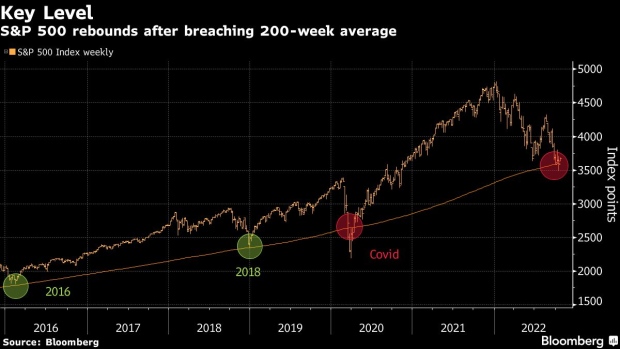

Stocks have started the week on a strong note. S&P 500 futures advanced 1.5%, extending a broad rally after the index closed above a key technical support level on Monday. At one point yesterday, more than 99% of the companies in the US equity benchmark were up.

Morgan Stanley’s Wilson wrote in a note on Monday that he “would not rule out” the S&P 500 rising to about 4,150 points -- a nearly 13% upside from yesterday’s close -- adding that this would be “in line with bear market rallies this year and prior ones.” Still, the chief equity strategist said he sees the bear market eventually bottoming at around 3,000 to 3,200 points.

JPMorgan’s Kolanovic sounded a downbeat note in a report to clients published late on Monday. His decision to trim risk allocations in the model portfolio follow a note earlier this month, when he cited the risks from hawkish central banks and the war in Ukraine. He flagged then that it may take longer for the S&P 500 to reach the firm’s year-end target of 4,800.

Prices so far this year have whiplashed from one session to the next, more so to the downside, indicative of the angst strategists and investors feel. An analysis from Bespoke Investment Group showed that over the last 200 trading days, the S&P 500 has only closed higher on 43% of them -- one of the weakest readings seen over the last 70 years.

Other Wall Street bulls are tweaking their predictions to match the challenges in the US economy. John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, cut his S&P 500 target on Monday, but made it clear that he’s still bullish on equities.

“We believe US economic fundamentals remain remarkably resilient, though challenged in a highly transitional environment by persistent high levels of inflation, increasingly restrictive monetary policy to address the inflation, and supply chain problems that remain as well,” he said in a note.

Read more: BlackRock Sees High Cost of Fed’s Path, Challenge for UK Leaders

©2022 Bloomberg L.P.