Mar 5, 2024

Sumitomo Pharma Cuts 400 US Jobs as Credit Market Concerns Mount

, Bloomberg News

(Bloomberg) -- Sumitomo Pharma Co. said it plans to cut about 400 jobs at its US subsidiary this month, pushing ahead with restructuring as debt market concern about its credit quality mounts.

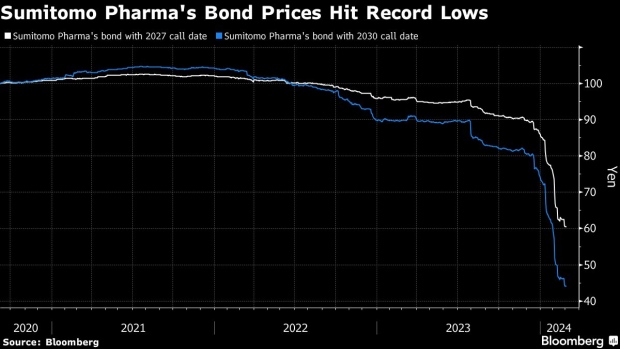

The Osaka-based drugmaker cited a “severe business environment” and the failure of three key drugs to meet its revenue goals as reasons for the job reductions. That followed cuts of around 500 jobs last year. The company’s subordinated yen bond due in September 2050 has fallen 41% this year to an all-time low of ¥44.1, putting it deep in distressed territory.

That’s the lowest price for any outstanding regular bond sold by a Japanese company in yen that hasn’t defaulted, according to Bloomberg-compiled data.

Sumitomo Pharma’s shares have also been weak, contrasting with its peers that have seen gains this year in line with the broad Topix index, which is about 6% away from record highs marked in 1989. The company’s stock has tumbled 23% so far this year, even as the Topix climbed 15% and the Topix pharma gauge gained 11%.

“We believe that the current decline in corporate bond prices is a result of the ongoing losses,” said Katsuya Kiyose at Sumitomo Pharma’s IR department. “We will make efforts to increase sales and cut global R&D expenses.”

Sumitomo Pharma’s fiscal third-quarter revenue dropped as US patents on anti-psychotic drug Latuda expired, and most of the assets it acquired to prepare for the expiry failed in development, while those have made it to market are doing poorly, according to a Jefferies report. The company widened its full-year operating loss forecast last month and cut its sales estimates for drugs including prostate cancer treatment Orgovyx in the US.

Rating & Investment Information Inc. will be monitoring whether the company’s relationship with its parent firm Sumitomo Chemical Co. will change as the group’s overall performance deteriorates, according to senior analyst Hideki Matsumoto. R&I grades the drugmaker A- with a negative outlook. Sumitomo Chemical also widened its full-year operating loss forecast due in part to the drug unit’s poor performance.

©2024 Bloomberg L.P.