Feb 10, 2023

Summers Sees Turbulence Ahead With Market Complacent on Inflation

, Bloomberg News

(Bloomberg) -- Former Treasury Secretary Lawrence Summers warned that complacency is setting into financial markets about inflation, and that the Federal Reserve may need to tighten further than what investors are currently expecting.

“We’re headed into what’s likely to be a turbulent period,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “I’m not sure we’re on a trajectory that’s going to get us to 2% inflation without more interest-rate increases than the market is now anticipating.”

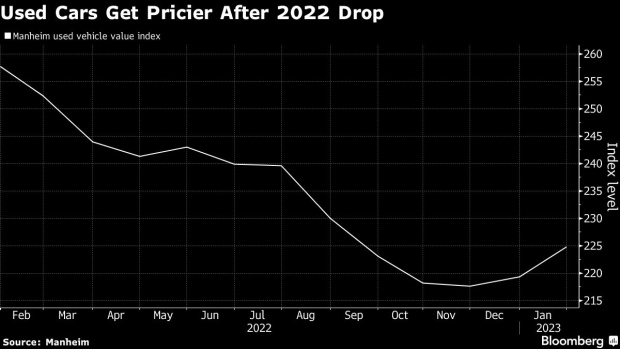

Summers cautioned that a number of factors that had been helping pull inflation down may reverse. One sign of that dynamic came from used-car prices, which climbed 2.5% last month — the most since the end of 2021, according to an industry report on Tuesday. Gasoline prices have also risen this year.

“There are a variety of bounce-back factors that we’re going to have,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television. For overall inflation, “the gains in terms of further reduction are going to come hard” going forward, he said.

395683331

He also worried that rallies in financial markets in recent months have left conditions looser than they ought to be given the amount of Fed tightening still to come, the still-high rate of inflation and the continuing strength in the job market. Futures contracts suggest traders see two more quarter-point interest-rate hikes, bringing the Fed’s benchmark to about 5.2%.

The risk is “this tightening cycle is not just about one more, two more, three more 25 basis-point increases, but something more fundamental,” Summers warned.

The consumer price index rose 6.5% in the year to December, well down from the peak gain of 9.1% in June. Next week, the government will release the January CPI, which economists expect to have climbed 6.2% on a year-on-year basis. The monthly gain is seen at 0.5%, still above the kind of pace consistent with 2% inflation.

“Consensus has become substantially too complacent about inflation,” Summers said. The rate of price increase is still “at levels that would have been unimaginable for inflation two years ago,” he said.

He also voiced confidence in the Fed’s recognition that the job isn’t yet done and that the outlook is substantially uncertain. Policymakers are “determined to do what is necessary,” he said.

Separately, Summers applauded Joe Biden’s focus in his State of the Union speech on the economic health of the middle class — “building from the bottom up and the middle out,” as the president puts it.

But the former Treasury chief, who also served as head of the National Economic Council in the Obama administration, expressed concern about the call to “buy American.”

Biden Plan

Biden in his Tuesday address announced there will be “new standards to require all construction materials used in federal infrastructure projects to be made in America.”

That approach will make projects more costly, ultimately requiring greater tax revenue to pay for the same amount of construction, Summers said. The extra cost would likely dwarf the hidden surcharges that Biden also targeted for action in his speech.

“My guess is that those higher prices — from things that we’re doing through policy — probably add more to consumer burdens than all the junk fees that the president spoke about,” Summers said, referring to Biden’s push against hotels, airlines and other companies’ hidden fees.

(Adds comments on ‘buy American’ push, in final five paragraphs.)

©2023 Bloomberg L.P.