Aug 24, 2022

Surviving Energy Bills Forces Drastic Steps by UK Businesses

, Bloomberg News

(Bloomberg) -- Baking at midnight. Closing down midweek. Covering a barn roof with solar panels.

Lisa-Jane Fraser is trying whatever she can to keep her wedding and restaurant business in rural England running as energy costs snowball. The monthly bill more than doubled to £3,800 ($4,512) in March, and she fears it may catapult to £7,000 in November, when her fixed-price contract ends and puts the venue at the mercy of a turbulent market.

“How can anyone operate a business without knowing what your fixed costs are going to be?” she said. “There has to be some financial support.”

Record-smashing increases in tariffs for gas and electricity threaten the livelihoods of small-business owners already facing double-digit inflation and cautious consumers. About 20% of UK businesses -- including high street shops, pubs and restaurants -- have to renew their energy contracts this October, according to consultancy BFY Group.

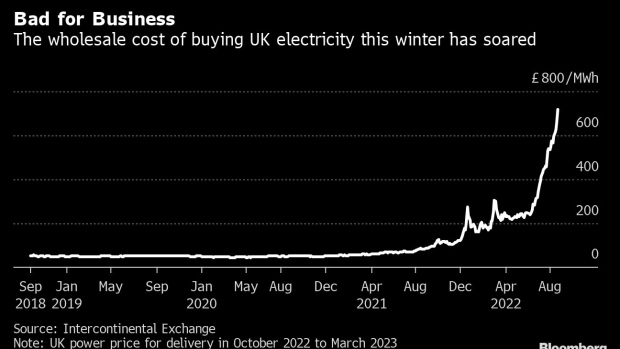

Prices have reached new highs as Russia severely limits gas supplies to Europe just as the continent tries to refill storage sites for the winter, when demand is greater. UK energy prices are trading at levels more than 10 times the seasonal average over the previous five years.

“You’re looking at winter prices that are eye watering,” said Nick Campbell, a broker at Inspired Energy Plc in Lancashire. “Some small- and medium-sized businesses are nailing themselves into a coffin.”

If Fraser’s prediction is accurate, the monthly bill for the 300-acre Frasers estate will be more than her mortgage payment. And that’s despite getting half of its supply from on-site renewable generators: a ground-source heat pump, an air-source heat pump and solar panels.

To conserve even more, Fraser plans to close her restaurant on Wednesdays and probably Thursdays, when demand is quiet. She’s also starting a wholesale business making Christmas puddings, sausage rolls and ready meals in programmed ovens between midnight and 5 a.m. -- hours when her tariff provides cheaper energy.

“They need to do a windfall tax on these great big utilities,” she said.

Unlike British households, businesses small and large aren’t covered by the price cap calculated every three months by energy regulator Ofgem. That leaves them fully exposed to the wholesale market if they’re not locked into fixed-price contracts with suppliers -- many of whom want customers off their books to reduce the risks to their own balance sheets.

Mark Hidgcock runs the hardware store his father started in the Midlands 34 years ago, but he doesn’t know how much longer he can go after being told his electricity bill could shoot to £21,000 a year -- six times higher than it is now.

“We’ve done everything right, ticked the boxes, run the business well,” Hidgcock said of his David Neill Mica Home & DIY in Derbyshire. “We have cash in the bank, but these increases could wipe us out.”

Prices have risen so much that locking in all non-household energy needs for the next 12 months would cost almost £110 billion, BFY said. That’s nearly a sixfold jump from a year ago -- much of which may be passed on to customers.

“Soaring energy bills are creating a cost nightmare for retailers at a time they are struggling to hold prices down,” said Helen Dickinson, chief executive officer of the British Retail Consortium.

And that cost-of-living squeeze will only get tighter. The UK’s economy is likely to fall into recession in the fourth quarter, with inflation reaching 12.6%, according to Bloomberg Intelligence.

Many companies that can afford to do it are desperately trying to plaster their buildings in solar panels because the payoff has accelerated so quickly, said Latif Faiyaz, head of trading at Northern Gas and Power Ltd., which procures and manages energy for large users.

Some clients have seen their bills jump by about nine times.

“It’s forcing companies to focus on energy efficiency and net-zero,” he said. “All of a sudden, they’re staring down the barrel.”

Robin Brown owns Yorkin Associates, which manufactures plastic products for utility and building companies. Yorkin faces a tripling in energy costs to £108,000 annually -- a rise that can’t easily be passed on because the supplier’s locked into long-term contracts with customers.

“Nobody seems to be taking it seriously,” Brown said. “With no cap on business energy costs, we feel we have no protection.”

©2022 Bloomberg L.P.