Oct 9, 2023

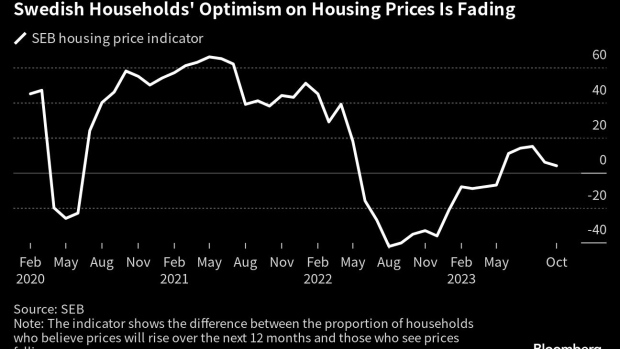

Swedish Households’ Optimism on Housing Prices Is Fading

, Bloomberg News

(Bloomberg) -- The outlook for prices in Sweden’s residential property market declined for a second consecutive month as rate expectations rose to the highest level in 15 years, according to a survey from the country’s largest bank.

The net balance of SEB’s Housing Price Indicator dropped two points in October to 4, well below the historical average of 32. The metric represents the difference between the proportion of people who believe in rising prices versus those who expect to see a decline.

Respondents expected interest rates to reach 4.39% in one year, which is the highest reading since October 2008. “There is still a fairly high likelihood that the Riksbank might raise the policy rate once more, in our view,” SEB economists Daniel Bergvall and Marcus Widen said in a note.

While recent home price data has shown some stabilization, the economists said they expect “a further decline in the coming quarters, due to the effect of rising rates and because inflation-eroded household income forces households to allocate less of their budge to accommodation.”

Read More: Sweden October SEB Housing Price Indicator: Summary (Table)

--With assistance from Joel Rinneby and Niclas Rolander.

©2023 Bloomberg L.P.