Dec 13, 2023

Temu Files New Lawsuit Against Shein After ‘Intensified’ Clash

, Bloomberg News

(Bloomberg) -- Chinese-owned online marketplace Temu sued fast-fashion rival Shein in the US over what it called “intensified” anticompetitive practices, reviving a legal fight between the e-commerce upstarts after both had dropped earlier lawsuits against each other.

Whaleco Inc., which operates as Temu, accused Shein of hatching a “desperate plan” to undercut its business in a 100-page filing to the US District Court for the District of Columbia — nearly triple the length of its original lawsuit. The Wednesday complaint alleged that Shein filed tens of thousands of copyright takedown notices against Temu, forced fashion suppliers into exclusive agreements, and threatened or even detained Temu merchants. It detailed allegations about how Chinese suppliers who listed products on both platforms got called into Shein’s offices in Guangzhou and forced to provide phone passwords and transaction records related to Temu.

“Temu has discovered that Shein’s anticompetitive behavior has not only persisted but intensified,” the lawsuit said. “Shein’s persistent and increasingly aggressive use of anticompetitive conduct, coercion, and threatening behavior necessitates this lawsuit.”

A Temu representative said the latest move was a result of Shein’s escalating anticompetitive behavior. “Their actions are too exaggerated; we had no choice but to sue them,” the spokesperson said.

In a statement on Thursday, a spokesperson from Shein said: “We believe this lawsuit is without merit and we will vigorously defend ourselves.”

Read More: Jack Ma’s Biggest E-Commerce Rival Is Coming for Amazon, Walmart

The two rising stars, both of Chinese origin, pose a growing threat to e-commerce giants from Amazon.com Inc. to Walmart Inc. and fast-fashion incumbents like H&M and Zara. In October, Temu and Shein both dropped previous lawsuits that pulled the curtain back on the combative competition between the two often-secretive companies.

Temu, owned by Chinese heavyweight PDD Holdings Inc., said its entry into the US market in late 2022 contributed to a decline of more than $30 billion in the valuation of Shein, which had exceeded $100 billion. “So Shein hatched a desperate plan to eliminate the competitive threat posed by Temu,” the lawsuit alleged.

Shein has filed confidentially for an initial public offering in the US, targeting a valuation of as much as $90 billion, Bloomberg News has reported.

Besides copyright infringement and supplier bullying, Temu’s new lawsuit accused Shein of seeking to “whitewash its stained reputation” by shifting its headquarters to Singapore — despite maintaining most of its business operations and employees in China. It’s a tactic that could backfire given that Temu is owned by PDD, founded eight years ago in Shanghai.

Temu Takes on Amazon and Walmart: The Big Take

The filing also contends that Shein poached several of Temu’s key marketing executives to replicate its game and promotional strategies, including one woman who may have begun working for Shein before she officially quit Temu. It accused Shein of signing agreements with suppliers that prevented them from doing business with rival marketplaces like Temu, and issued penalties for not allowing Shein to offer prices lower than competitors.

The latest suit comes as Temu has widened its gap with Shein in US transactions since surpassing it in May. That lead has widened every month since, reaching nearly triple Shein’s observed sales in November, according to data from Bloomberg Second Measure, which analyzes consumers’ card transactions.

Temu-parent PDD’s market capitalization even exceeded that of Chinese e-commerce pioneer Alibaba Group Holding Ltd. in recent weeks, in part because of Temu’s success abroad.

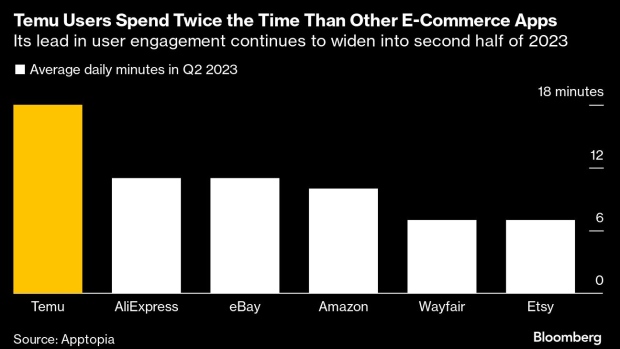

Read More: Shoppers Spend Almost Twice as Long on Temu App Than Key Rivals

--With assistance from Daniela Wei.

(Updates with Shein comment in fifth paragraph)

©2023 Bloomberg L.P.