Jun 8, 2023

Tesla’s AI Dreams May Already Be Priced Into Stock

, Bloomberg News

(Bloomberg) -- When it comes to Tesla Inc. and artificial intelligence, few are on the same page as Cathie Wood.

According to the chief executive officer of ARK Investment Management, the electric carmaker is the biggest AI play, which will help its stock price rise to about $2,000 in 2027 from around $225 currently. The majority view on Wall Street is that potential is already incorporated in the company’s rich valuation.

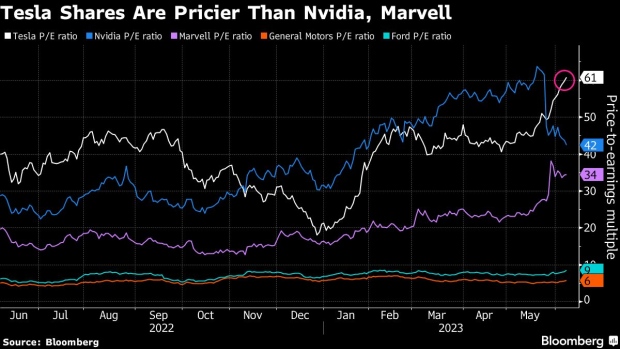

“If you look at how other auto companies are priced and compare that with Tesla’s valuation premium, that delta shows you the AI opportunity is already priced in,” Catherine Faddis, senior portfolio manager at Fernwood Investment Management, said in an interview. “And it is not as if General Motors or Ford are not doing electric cars either, so that makes the valuation difference even starker.”

While Tesla is developing what is arguably one of the more ambitious AI projects — cars that can drive themselves — the stock’s hefty valuation premium leaves little room for investors who are trying to get in on the ground floor of an emerging new technology.

After an 82% year-to-date rally, Tesla shares traded at about 61 times forward earnings as of Wednesday’s close, compared with the mid-to-high single-digit multiples of auto stalwarts General Motors Co. and Ford Motor Co. Even current AI darling Nvidia Corp. trades at only 42 times.

In fact, Tesla CEO Elon Musk himself suggested last year — long before the present rush for AI — that the company’s value was almost fully dependent on cracking the code for self-driving. “That really is the difference between Tesla being worth a lot of money and being worth basically zero,” Musk said in an interview in June 2022.

The stock, while more than 40% below its record highs of 2021, is still worth over $700 billion, comfortably exceeding the combined market value of the six biggest global automakers, all of which have EV and self-driving efforts underway.

Tesla already offers a driver-assistance technology that it calls Full Self-Driving, even though a truly self-driving car has remained elusive for the industry. Ford and Volkswagen’s Argo AI shut down last year, while the initial excitement around Alphabet Inc.’s Waymo and GM’s Cruise have sputtered as well.

“Tesla’s AI is also a valid form of AI. But as we have found, it is much harder to drive a car from 57th Street to Wall Street in Manhattan, than it is to have generative AI write you a novel,” Nicholas Colas, co-founder of DataTrek Research, said in an interview.

Believers Steadfast

Still, as more investors start paying attention to companies exposed to the AI opportunity, believers in Tesla’s longer-term goals say it can be one of the best plays on the theme.

“Autonomous taxi platforms globally will deliver by 2030 $8 trillion to $10 trillion in revenue, from almost zero right now,” ARK’s Wood told Bloomberg TV in an interview last week. Her estimate of Tesla shares reaching $2,000 by 2027 is dependent on the EV maker playing a big role in that future. Without that AI push, Wood expects the stock to be worth only about $400 by the same time.

Wood does have some supporters, as the stock’s most recent rally also suggests. Tesla shares rose for a ninth straight session on Wednesday, the longest such streak since January 2021. The stock wavered between gains and losses at the open Thursday.

To Brian Mulberry, client portfolio manager at Zacks Investment Management, investors do not yet fully appreciate Tesla’s AI opportunities. He believes most of the company’s present valuation only reflects its success in the consumer EV markets where it is the dominant player, and ignores other opportunities, including AI.

Overall, “considering the current upswing in AI related names, we believe Tesla should enjoy participation in the excitement,” Mulberry said.

Tech Chart of the Day

Tesla has been riding on insatiable investor appetite for mega-cap tech stocks and a string of recent positive news.

Top Tech Stories

- GameStop Corp., the struggling video-game retailer, fired Matt Furlong, its chief executive officer for the past two years, and said Chairman Ryan Cohen will take on a new executive role. The shares plunged more than 20%.

- ByteDance Ltd.’s TikTok aims to more than quadruple the size of its global e-commerce business to as much as $20 billion in merchandise sales this year, banking on rapid growth in Southeast Asia, according to people familiar with the matter.

- Electric-vehicle sales are poised to more than double by 2026 but eliminating emissions from road transportation by the middle of this century will require even greater efforts, according to BloombergNEF.

- Holders of Byju’s $1.2 billion term loan and their advisers are weighing options including negotiating with the company for an amendment, litigating or attempting to seize collateral after the firm missed an interest payment on the debt, according to people with knowledge of the matter.

- Spotify Technology SA is in talks to make the popular podcasts Armchair Expert and Anything Goes available on other streaming platforms, reversing its strategy in order to attract more listeners and boost revenue for the shows.

- Crypto exchange Binance and related entities shuttled some $70 billion through accounts at now-defunct Silvergate Bank and Signature Bank from 2019 up until this year, including “large amounts of money” flowing in and out within days, according to new details revealed in a filing Wednesday.

- Cathie Wood said Binance Holdings Ltd.’s US legal problems will benefit Coinbase Global Inc. because it would eliminate its main competition.

- The value of US semiconductor imports fell 16% in April from the month prior, but manufacturers in Asia, America’s main supplier, still have reasons to be optimistic.

--With assistance from Subrat Patnaik and Rheaa Rao.

(Adds stock move in twelvth paragraph.)

©2023 Bloomberg L.P.