May 20, 2020

Thailand Cuts Rate for Third Time as Economic Crisis Worsens

, Bloomberg News

(Bloomberg) -- Follow Bloomberg on LINE messenger for all the business news and analysis you need.

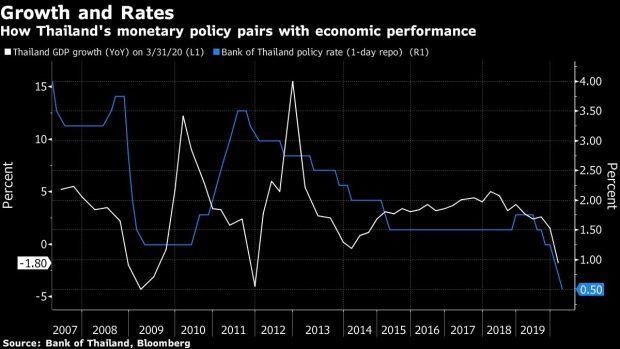

The Bank of Thailand cut its benchmark interest rate to a fresh record low and said it was ready to use additional policy tools if needed with the economy expected to shrink further.

By a 4-3 vote, the central bank lowered the policy rate Wednesday by 25 basis points to 0.5%, its third cut this year. All but three of 24 economists in a Bloomberg survey correctly predicted the decision, with the others expecting no change.

The central bank “looks ready to use other, albeit unspecified tools, which implies other measures aside from policy easing, especially as the room for lower rates is declining,” said Mitul Kotecha, a senior emerging markets strategist at TD Securities in Singapore.

Thailand’s economy contracted the most since 2011 in the first quarter as the pandemic slammed the nation’s two key drivers - exports and tourism. The state planning agency earlier this week forecast the economy would contract as much as 6% this year, its worst economic performance since the Asian financial crisis more than two decades ago.

The Bank of Thailand warned Wednesday that this year’s contraction might ultimately be more severe as the blow to exports and tourism was greater than expected. The travel outlook remains bleak, with Thailand’s borders mostly closed as part of a state-of-emergency order imposed in March that lasts through May. Most inbound international flights are banned until the end of June.

In its statement Wednesday, the central bank said it was worried about the recent strength in the baht, which has gained more than 1.8% in the past month to be the second-best performer in Asia. The baht was little changed at 31.887 to the dollar after the decision.

“Prospects for more easing will at least in part be contingent on the baht,” said Kotecha. “Further appreciation will likely trigger more easing. BoT is clearly concerned about baht strength.”

SME Support

Wednesday’s monetary policy easing adds to the government’s fiscal stimulus, which World Bank estimates place at 15% of GDP, among the highest in the region. That includes $12 billion in emergency cash handouts to encourage consumer spending.

The central bank’s assistant governor, Titanun Mallikamas, said unemployment as a result of the pandemic had contributed to the economic contraction and said support should be provided to small and medium-sized enterprises.

The government began easing some restrictions in early May, with shopping malls and retail businesses allowed to reopen since last weekend. Still, the pace of recovery -- and future policy actions -- will likely depend on how quickly external drivers such as exports and tourism revive.

“We expect a further 25 basis-point cut in the third quarter, taking the policy rate to 0.25%,” said Tim Leelahaphan, an economist at Standard Chartered Plc in Bangkok. “We do not rule out further policy rate cuts below the 0.25% level.”

(Updates with analyst quotes in third and final paragraphs, baht level in sixth paragraph.)

©2020 Bloomberg L.P.