Apr 13, 2023

The Once-Mighty Eurodollar Futures Contract Will Soon Be No More

, Bloomberg News

(Bloomberg) -- A cornerstone of the US interest-rates market for a generation of traders will mostly cease to exist after Friday.

As part of the long-planned transition away from the scandal-plagued London interbank offered rate borrowing benchmarks, derivatives linked to them will also be phased out. That means that eurodollar futures and options — for decades the bread and butter of those wagering on Federal Reserve decisions or hedging moves in short-term interest rates — will soon be gone.

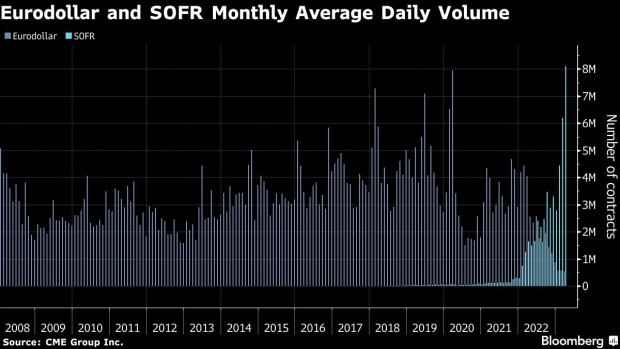

Friday is when CME Group Inc., the exchange operator that lists the contracts, will convert those expiring after June to futures or options on the Secured Overnight Financing Rate, which have overtaken eurodollars in trading volume. SOFR is a relatively new benchmark that officials favor as a successor to Libor in dollar funding markets.

“It’s the end of an era,” said Paul Muoio, chief executive officer of Yellowhook Capital, who started trading futures in 1987 and headed a sales desk at Citigroup Inc. until 2014. “A lot of people cut their teeth in and made their fortunes off of eurodollars.”

Eurodollars debuted in 1981 and became CME’s biggest product in terms of volume and open interest by 1988. They are futures on the three-month US dollar Libor, a decades-old reference rate for bonds, loans and other forms of credit. Their demise is a result of the emergence beginning in 2008 of evidence that Libor had been manipulated by the lenders that contributed the rates used to calculate it.

A panel of industry representatives and regulators picked SOFR to replace US dollar Libor in 2017. Regular publication of three-month Libor will end on June 30, though a synthetic version will be available until September 2024.

Under plans in development since 2019, eligible eurodollar futures will be converted to SOFR equivalents at a fixed spread of 26.161 basis points. That figure was established through the historical difference between Libor — an unsecured rate — and SOFR, which is based on secured loans and published by the New York Fed. Options will be converted based on their strike prices.

Read: Synthetic Libor Could Help Some Put Off an Inevitable Transition

Traders and investors have used eurodollar futures and options — and now their SOFR counterparts — to express predictions for US monetary policy, because the rates they reference are influenced by the interest rate set by the Fed. While CME also lists futures on the federal funds rate itself, trading volume in that product typically has trailed eurodollar and SOFR futures volumes by wide margins, making it a less efficient market.

High levels of uncertainty about the course of Fed policy following nine rate increases since March 2022 have aided the surge in SOFR activity this year.

The end of eurodollars would have been inconceivable before 2008, when lots of 25,000 to 50,000 were routinely traded, Muoio said. He said his biggest eurodollar trade was 96,000 contracts.

“I would’ve said ‘No — expletive — way,’” he said.

Most users of short-term interest-rate futures and options have already switched to SOFR from eurodollars. According to CME, open-interest in SOFR products is about 50 million, while open interest in eurodollars slated for conversion had dwindled to about 7 million as of last week. It peaked at nearly 85 million in June 2019.

Options on eurodollar and SOFR futures are the only remaining products for which CME still maintains a trading floor in Chicago, though they also trade on its electronic platform.

(Corrects end date for synthetic Libor in sixth paragraph.)

©2023 Bloomberg L.P.