Feb 17, 2023

This Week in China: Missing Banker Mystery Adds to Wave of Risks

, Bloomberg News

(Bloomberg) -- Traders are struggling to decide whether China’s markets have topped out, with those who invested early in the reopening trade reducing risks, while others who missed the boat wait for a March catalyst.

Buffeted by crosscurrents ranging from US-China tensions, a high-profile investment banker’s disappearance and economic stimulus, investors are erring on the side of caution. Beijing’s wariness over leverage and determination to reduce financial risk is also limiting liquidity flowing into financial markets.

The Hang Seng China Enterprises Index, which fell into a technical correction this week, hasn’t posted back-to-back gains in 15 trading days. That’s the longest streak since early August, a month of brief stability in what later became the index’s worst quarter since China devalued the yuan in 2015.

The fast money that pumped billions of dollars into the reopening trade is getting a strong reminder of how a buy-and-hold strategy rarely works in Chinese markets. Optimism around the post-Covid economy is giving way to doubts over the strength of the consumer, speculation about the next regulatory ax to fall and concern that tensions with the US will worsen.

Here’s my roundup of the week’s key developments for China markets.

Clashes with the US

China imposed fines and sanctions against two US defense companies, saying they were involved in the sale of weapons to Taiwan. The firms don’t do much business in China but it’s a symbolic move. US President Joe Biden said he intends to speak with Chinese leader Xi Jinping after Beijing questioned the US’s “sincerity” about wanting to stabilize relations.

- China Warns US That Rising Tensions Could Jeopardize Talks

- China Hits at US With ‘Symbolic’ Sanctions on Lockheed, Raytheon

- Biden Intends to Speak With Xi to Ease Tensions Over Balloon

Stolen data

Dutch chip giant ASML Holding NV accused a former employee in China of stealing confidential information — the second breach linked to the country in less than a year. ASML, which employs about 1,500 people in China, is already restricted by the Netherlands government from selling its advanced chipmaking machinery to the country.

- ASML Says Chip Data Stolen Again in Incident Linked to China

Missing banker

Top dealmaker Bao Fan is unreachable, according to China Renaissance Holdings Ltd., which is led by Bao as chairman, CEO and controlling shareholder of the investment bank. The stock fell 28% in Hong Kong on Friday. Xi launched a broad anti-corruption probe in late 2021 targeting the financial sector, which brought down dozens of officials and ensnared China’s investment bankers.

- China’s Top Tech Banker Goes Missing, Unnerving Finance Industry

Incoming regulators

China will appoint new chiefs for its banking and securities watchdogs. Yi Huiman will have oversight of the world’s largest banking system. He gave markets more sway, allowed foreign banks to fully own their onshore units and halted Ant Group Co.’s IPO during his stint as head of the CSRC since 2019. His successor will be Wu Qing, a man known as the “broker butcher.”

- China Set to Name New Chiefs at Banking, Market Regulators

- ‘Broker Butcher’ Set to Be China’s Top Securities Regulator

Broken stimulus

Instead of using cheap loans to spend money on goods and services, China’s consumers are investing in financial instruments or prepaying mortgages. The widespread arbitrage practice is frustrating some of China’s stimulus efforts, potentially undermining a recovery in the world’s second-largest economy. Reviving consumption in the post-Covid era is a key focus for Xi.

- Xi’s Consumer Boom Thwarted by Secret Trades, Debt Misuse

- China’s Xi Urged Stronger Measures to Boost Domestic Demand

Record cash

China’s central bank offered a ton of short-term funding to the financial system on Friday, the most since at least 2004. That’s after it withdrew liquidity and refrained from cutting rates on longer-term loans. The PBOC is being flexible and nimble with its monetary policy as the path of the post Covid-Zero economy remains unclear.

- China Adds Most Short-Term Cash Ever to Avoid Liquidity Stress

Covid victory

Beijing patted itself on the back, saying its adjustment of Covid Zero policies was “totally right” and that public opinion would agree. China’s Covid situation is improving while the global pandemic remains, top leaders said in a meeting. Officials also declared victory over the virus back in 2020.

- China’s Leaders Declare Victory Over Covid as Deaths Drop

... and three things to watch for next week

- A potential rate cut? The central bank’s liquidity operations mean Monday’s loan prime rate print could be a little more interesting than expected. Focus is on the five-year rate as that is the one that matters for mortgages.

- Antony Blinken and Wang Yi will both attend the Munich Security Conference in Germany. Of interest is whether the two top diplomats will revive talks postponed after the Chinese balloon incident.

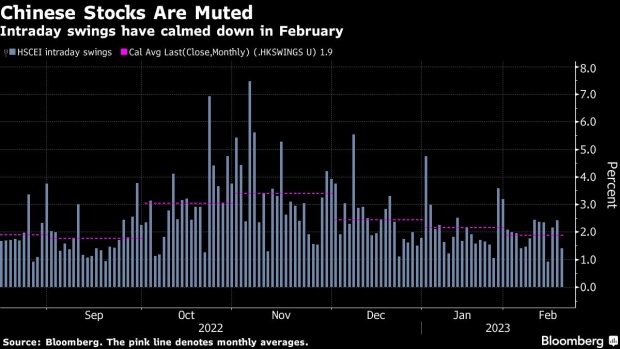

- I charted intraday swings in the Hang Seng China gauge to check whether moves in the stock market were indeed getting more muted. After four volatile months, average swings in February are turning less extreme. Let’s see if this lasts.

©2023 Bloomberg L.P.