Feb 3, 2023

Trader Bags $10 Million in Bold Fed Bet Minutes Before Jobs Data

, Bloomberg News

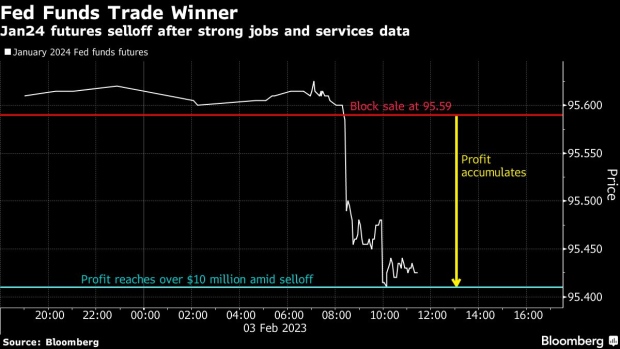

(Bloomberg) -- Just minutes before the monthly jobs report was published on Friday, a trader placed a risky bet in federal funds futures that ended up paying off in a big way.

Profits on the position, a sale of the January 2024 contract betting on higher interest rates, were north of $12 million by 3 p.m. in New York, following the publication earlier in the day of strong jobs numbers and another report from the Institute for Supply Management that suggested services activity in the US re-accelerated last month. Both releases led investors to price in additional expected tightening from the Federal Reserve this year.

The trade was done via a block sale for 13,996 contracts, equivalent to approximate risk of $580,000 of profit or loss per each basis-point move in the contract. It was placed around 8:15 a.m. by a seller, according to traders familiar with the flow.

The contract reached a low of 95.37 around 2 p.m., implying a federal funds rate of 4.63% on average in January 2024. That compares with a contract price of 95.59, or an implied rate of 4.41%, when the bet was placed.

A Bloomberg analysis of screen volumes suggests that the trade has yet to be unwound as of 3 p.m. The position stands to gain further in value should investors continue to price in additional Fed tightening this year.

Following Friday’s strong data, around 24 basis points of rate hikes are now priced in for the Fed’s next policy meeting in March, up from 21 basis points as of Thursday’s close. For the next two meetings in March and May combined, markets are pricing 41 basis points of hikes, up from 32 basis points Thursday.

©2023 Bloomberg L.P.